Investors’ concerns that a recession is imminent in the US economy have subsided in light of encouraging data.

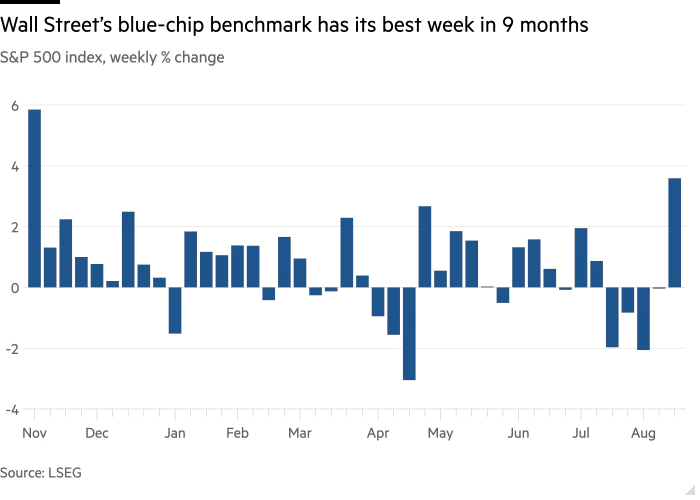

Global stock markets had their best week since November as investors overcame recent concerns that the US was headed toward a recession and volatility subsided.

Global equity markets have recovered dramatically from a sell-off earlier in the month, helped by a string of positive US data points that indicated resilient consumers and declining inflation.

The S&P 500 index on Wall Street ended a four-week losing run by finishing the week up 3.9%; on Friday, it added 0.2%, marking its best performance since November.

Joe Mazzola, head trading and derivatives strategist at Charles Schwab, stated, “A lot of the fear and trepidation has been taken out.” “The US economy is slowing down, as indicated by the data, but that was to be expected after two years of rate hikes. It’s just when [a slowdown] starts to actually manifest itself [that] people get nervous.”

The gains brought the blue-chip benchmark down to just 2% from its record high, which was attained a month prior.

Japan’s stocks, which took the brunt of the world market sell-off at the beginning of August, jumped 3% on Friday, giving them a weekly gain of 7.9%, while the Stoxx Europe 600 index gained 0.3% to be 2.4% higher.

It was also the best week since early November for the daily-calculated MSCI World index of developed market stocks worldwide.

Regarding the direction of interest rates, investors were anticipating additional hints from the Federal Reserve at its next Jackson Hole symposium on Friday.

Ian Lyngen, head of US rates strategy at BMO Capital Markets, stated, “Our expectations are for [Fed chair Jay] Powell to more clearly signal that we will see a September cut and offer greater context for what the Fed envisions for the pace of forward rate reductions.”

Data indicating the US economy was holding up better than anticipated contributed to this week’s market recovery. Wednesday’s inflation data revealed that the annual increase in the consumer price index slowed to less than 3% for the first time since March 2021. On Thursday, however, robust retail sales in the US and fewer than anticipated new unemployment claims increased investor confidence.

A measure of consumer confidence that was released on Friday exceeded estimates and increased from the eight-month low it had reached in July. Wall Street’s “fear gauge,” the Vix volatility index, fell below 15 after reaching a four-year high of 65 during the sell-off earlier in August.

According to Wei Li, global chief investment strategist at BlackRock, “the moves over the last couple of weeks demonstrate how market narratives can swing based on single data points and we could see more volatility ahead.”

Fed funds futures on Friday implied investors had fully priced in three quarter-point interest rate cuts by year-end, and saw a strong possibility of an additional one. Less than two weeks ago, recession fears had investors betting on a drastic half-point cut as soon as next month.

US two-year bond yields, which closely track rate expectations, ended Friday at 4.05 per cent, up 0.39 percentage points from their recent low on August 5. Yields move inversely to prices.

Leave a Reply