Recent market trends and data are fueling the ongoing rivalry between Dogecoin (DOGE) and Solana (SOL), which is intensifying. Although both cryptocurrencies have experienced growth, it is still unclear which will yield higher profits.

Read also: Analyst: Dogecoin’s Reign as Meme Coin King is Ending

In recent weeks, Dogecoin—which is frequently written off as just a meme coin—has steadily increased in value. Known for its speed and scalability, Solana has experienced greater swings in price, with higher highs and lower lows.

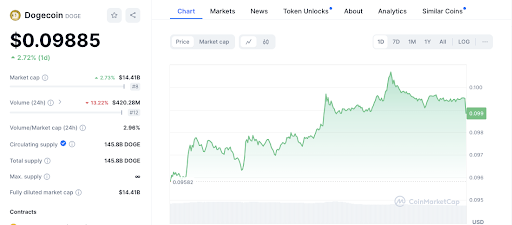

Source: Coinmarketcap

The price of Dogecoin has gradually increased over the last week. According to Coinmarketcap, DOGE has increased in value by 4.03% over the past day to reach $0.09957 as of this writing. Resistance to this rise has been encountered at the $0.100 mark, indicating that more gains might be difficult to achieve.

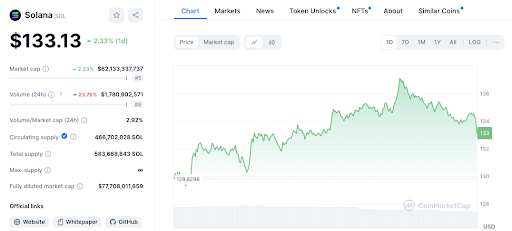

Moreover, Solana increased by 3.64% to $134.31. It too faced resistance at $136, leading to a slight pullback.

Although DOGE’s price has been rising steadily recently, it is running into resistance at the psychological $0.100 barrier. Price retreats from this region on multiple occasions, indicating that breaking through is challenging.

Source: Coinmarketcap

Buying interest has been observed at $0.095, where DOGE looks to have strong support. A 9.54% decline in trading volume, however, raises the possibility that the upward trend is not very strong. This volume drop, especially near resistance, suggests that it might be challenging to break above $0.100 in the absence of new buyers.

Read also: Solana Meme Coins Face Market Headwinds

Solana’s ascent has also run into resistance at $136, which has resulted in a retreat. SOL has strong support at $130, the price at which it has recovered.

Source: Coinmarketcap

The sustainability of Solana’s recent gains is called into question by a notable 21.60% decline in trading volume. This decline in volume, particularly close to resistance, indicates that SOL might have trouble rising above $136 unless fresh buying interest appears.

DOGE/USD 1-week price chart, Source: Trading view

Additional information is provided by technical indicators. DOGE’s one-week RSI is 43.41, approaching but not quite reaching oversold conditions. This implies that DOGE has not reached an oversold state, even though it may be getting close to a point where buying pressure could pick up. Given that DOGE’s 1-week MACD is trading below the signal line, there may be immediate downward pressure.

SOL/USD 1-day price chart, Source: Trading view

Solana, on the other hand, has a 1-week RSI of 48.12, which indicates a neutral position devoid of overbought or oversold indications. Solana’s one-week MACD is likewise below the signal line, indicating some short-term downward pressure.

Notice: The data in this article is solely intended for educational and informative purposes. The article does not provide financial advice or any other type of advice. Coin Edition disclaims all liability for any damages resulting from the use of the products, services, or content that are mentioned. Before making any decisions regarding the company, readers are urged to proceed with caution.

Leave a Reply