The US SEC targets Chris Larsen and Brad Garlinghouse, the CEO of Ripple, in the XRP lawsuit appeal. This has sparked discussion about the agency’s intentions and possible ramifications for the future of cryptocurrencies.

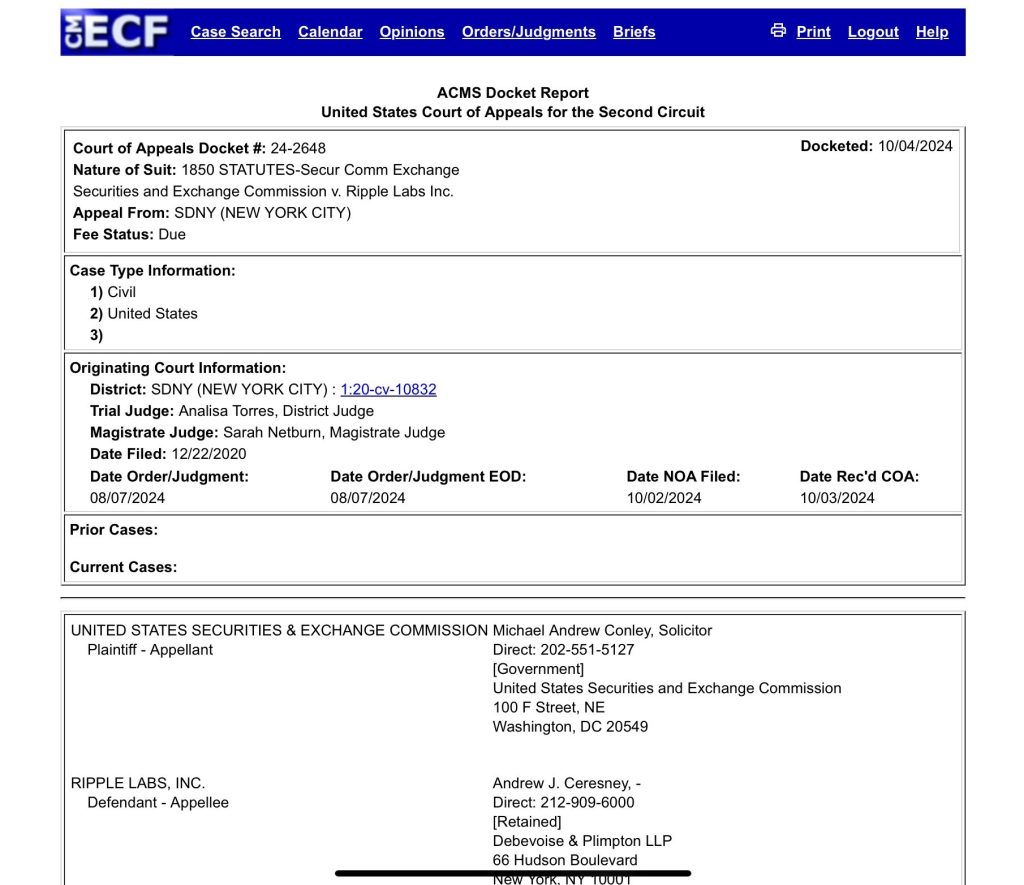

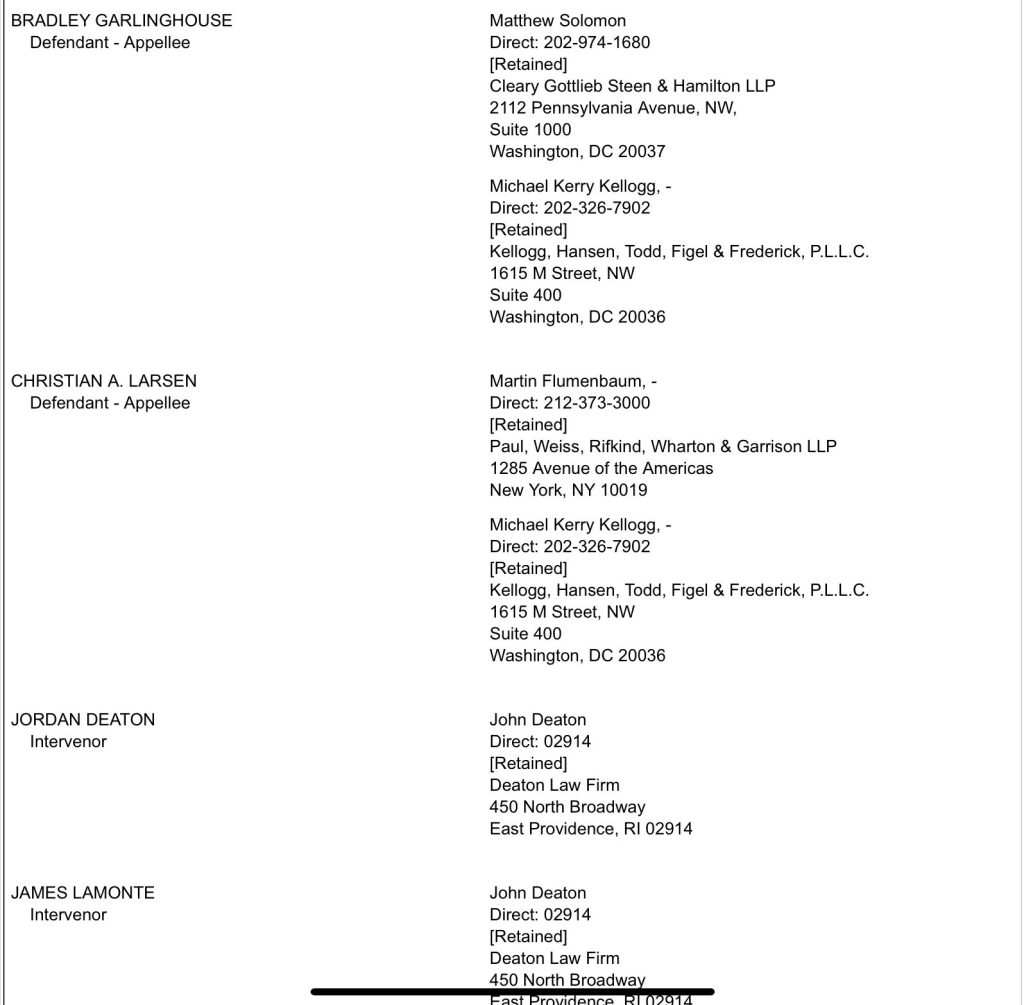

Recently, the XRP lawsuit has received a lot of attention and has sparked conversations within the larger cryptocurrency community. Prominent attorney James K. Filan revealed in a recent X post that the US SEC has formally appealed Ripple to the Court of Appeals for the Second Circuit. The official appeal also goes after co-founder Chris Larsen and CEO Brad Garlinghouse of Ripple, igniting discussions among XRP enthusiasts about the agency’s possible motivations.

US SEC Targets Ripple Execs In Official XRP Lawsuit Appeal

Raising eyebrows in the cryptocurrency market, the US SEC has included Ripple executives Brad Garlinghouse and Chris Larsen in the most recent official appeal in the XRP lawsuit. This development follows the first trial, in which the agency was unable to establish its allegations against the two executives. Additionally, it was filed shortly after the US SEC recently filed a notice of appeal.

Legal experts believe that the agency is trying to look back at some aspects of the case with this most recent inclusion. According to the legal expert, it specifically targets the executives over the dismissal of the claims made against them.

In the meantime, former SEC attorney Marc Fagel hinted in a recent X post that the appeal might include the dismissal of the charges against Brad Garlinghouse and Chris Larsen. This perspective is consistent with that of pro-XRP attorney Bill Morgan, who maintains that the agency approved the rejection of certain claims made against the Ripple executives.

But the fact that they are included in the appeal once more raises questions regarding the SEC’s approach. One user, who pointed out that Garlinghouse is no longer directly involved in the XRP lawsuit, expressed frustration with the SEC’s tactics.

The user implied that the SEC is trying to “splurge” on its claims and change the story, saying, “It is typical SEC behavior.” Notwithstanding these annoyances, it appears that the XRP holders might have to prepare for a drawn-out legal battle as the appeal court hears the case.

XRP Price Soars Despite US SEC Appeal

Today, the price of XRP increased by almost 2% to $0.5337, while its trading volume decreased by more than 32% to $1.20 billion. Notably, in spite of the US SEC’s appeal filing in the XRP lawsuit, the cryptocurrency has seen highs of $0.5384 and lows of $0.5172 in the past 24 hours.

In the meantime, in light of this legal battle, conversations regarding Ripple’s On-Demand Liquidity (ODL) system have also resurfaced amid the most recent appeal filing. Some have questioned if the accusations against Garlinghouse and Larsen have anything to do with ODL sales, which are sales of XRP to institutional clients.

Although ODL sales are a component of Ripple’s institutional operations, Bill Morgan made it clear that these accusations did not pertain to the executives. In response to the user’s allegations that ODL was central to the case, Morgan also denied any connection between ODL and Garlinghouse and Larsen’s programmatic sales.

Stuart Alderoty, the CLO of Ripple, made a suggestion about a cross-appeal in the case in a recent X post. In addition, the agency has encountered strong criticism from the cryptocurrency community regarding its appeal decision, which the market had eagerly awaited.

1 Comment