Key takeaways:

- Over 130 countries are now deciding whether to launch a central bank digital currency

- CBDCs have already launched in China, India, Nigeria, and across The Caribbean

- They’re a digital form of coins and banknotes, often based on top of blockchains

- Potential benefits include faster and cheaper payments for businesses and consumers

- But critics claim they could erode privacy and be used to surveil on the public

Digital currencies issued by central banks have been hailed as the money of the future, a replacement for actual banknotes and coins that lost favor during the coronavirus pandemic.

Although there is a lot of criticism, CBDCs see blockchain technology as a key component of a modern financial system. There have been worries expressed regarding possible privacy implications, and there are rumors that they could be used to restrict our spending.

Here, we will take a closer look at these digital assets, covering everything from their possible uses to the nations in which they are currently operational. We will also look at the differences between decentralized cryptocurrencies such as Bitcoin and CBDCs.

What is a CBDC?

A nation’s monetary policy is largely determined by its central bank, which also issues currency, sets interest rates, and works to control inflation. There is just one small issue: the proportion of people who still rely on physical currency has significantly decreased in recent years. This has happened in tandem with a sharp increase in the volume of online transactions. According to data from the US Federal Reserve, in 2023, only 12% of payments made by Americans under 55 were made with cash. Central banks are concerned about the similar trends we are witnessing occur globally. The fact that businesses and consumers are depending more and more on infrastructure from private institutions worries policymakers. Additionally gaining traction are stablecoins, which are virtual currencies linked to fiat currencies like the US dollar. Digital currencies issued by central banks have been hailed as their solution to this problem. As a result, central banks would issue electronic currency in addition to paper money and metal coins. To be mindful of, there are two primary categories of CBDC.

Retail CBDCs

Retail CBDCs are intended to be used for daily transactions by businesses and regular consumers, as the name implies. Money would be kept on a digital device in a wallet. Although one could contend that this could displace banks and even render them obsolete, numerous nations have plans in place to guarantee that financial institutions will be crucial in providing CBDC wallets to their clientele.

Wholesale CBDCs

The general public is not supposed to use this kind of CBDC. Rather, the goal is to make it possible for banks to settle big transactions between one another much faster and cheaper than they currently can. Additionally, it might facilitate easier cross-border payments. This infrastructure has been put through its paces in global tests involving several nations. Preliminary results indicate that they increase transparency and pave the way for conditional payments, in which money is released only after specific requirements are fulfilled.

Who is Developing CBDCs?

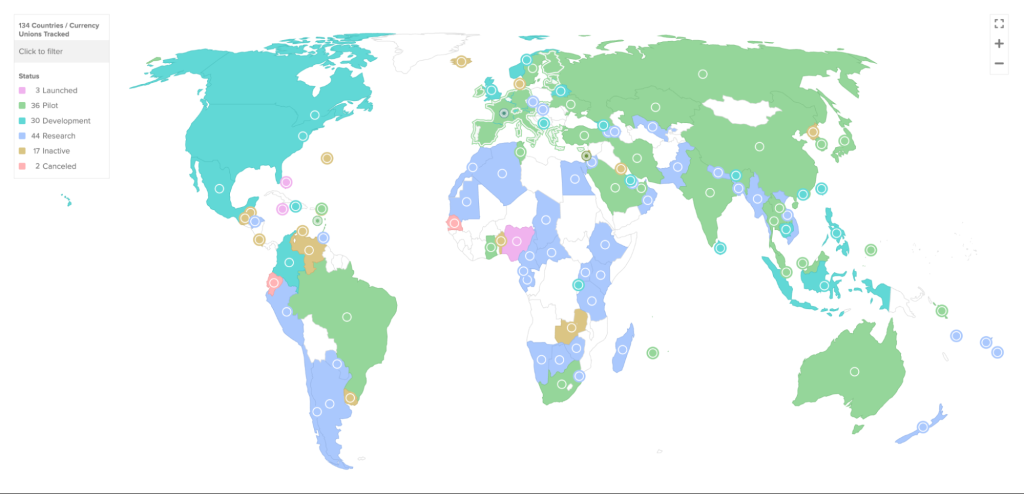

For a number of years, the U.S. think tank Atlantic Council has been monitoring the evolution of digital currencies issued by central banks. It claims that more than 130 nations and currency unions, which together account for 98% of the global GDP, are currently debating whether to introduce a CBDC. Numerous organizations are currently working on public pilot projects or are far along in constructing the infrastructure needed to power these digital assets. There have also been extensive consumer and business consultations.

Examples of CBDCs

In an apparent attempt to gain a first-mover advantage and strengthen the clout of their fiat currency, certain nations have been fighting to be the first to introduce a CBDC to the general public. Others have taken a more circumspect stance, choosing to “wait and see” and observe how the rollout plays out in other regions.

The Bahamian Sand Dollar

In October 2020, The Bahamas became the first nation in the world to introduce a fully operational CBDC, making history in the Caribbean.

The Bahamian dollar is pegged one-to-one with the US dollar, and the Bahamian Sand Dollar is its electronic equivalent.

This CBDC is only available through specific apps on iPhone and Android devices, as well as physical payment cards. It is only operational within the nation.

Modernizing the nation’s payment systems, combating money laundering, and addressing the issue of counterfeit coins and banknotes are just a few of the objectives that have been made clear.

DCash

The Eastern Caribbean Central Bank introduced DCash, a service that operates on eight islands, elsewhere in the region. Peer-to-peer transactions via smartphones make financial inclusion possible for people without bank accounts, which is one of the main objectives of this project. The creation of DCash 2.0 is currently in progress, with the goal of enhancing user experience and offering programmable and recurring payment options.

JAM-DEX

The official CBDC of Jamaica is JAM-DEX, with the tagline “no cash, no problem.” Unlike banks, which only provide their services during business hours on weekdays, this digital asset guarantees the financial system runs 24/7, year-round, and allows payments to be made through QR codes.

Digital yuan

China’s digital yuan has drawn a lot of attention, mainly due to its size and status as an economic superpower. Currently accessible in numerous cities and undergoing additional rollouts, Beijing created a stir when revealing it would accept payments during the 2022 Winter Olympics. Banking officials claim that this CBDC provides “controlled anonymity,” which implies that the confidentiality of transactions is only partially guaranteed.

Digital rupee

Launched in December 2022, India’s CBDC, or digital rupee, seeks to lower the enormous expenses related to printing actual currency. While consumers and businesses can use a retail-facing alternative, financial institutions can use a wholesale version. The digital rupee was used for one million transactions every day a year after its launch, according to an announcement from the Reserve Bank of India. However, this was primarily due to bank incentives encouraging their customers to use the currency.

eNaira

In October 2021, Nigeria’s central bank introduced a CBDC, making it the first in Africa. Transaction limits for the eNaira, which is based on the Hyperledger Fabric blockchain network, are established based on the completion of a customer’s know-your-customer checks. The most money that can be kept in a wallet by someone with just a phone number is 120,000 naira, or roughly $75. If they possess a National Identity Number, that amount increases to 300,000 naira ($185), and if they have a Bank Verification Number, it increases to 500,000 naira ($308).

What about the US, UK, and the EU?

When it comes to introducing a CBDC, other significant economies have lagged behind, and some have not even made up their minds to create one. According to prior statements, the Federal Reserve is “nowhere near recommending, let alone adopting, a central bank digital currency” in any capacity. Rather, the focus has been on conducting technology experiments and holding consultations. Concerns about privacy have also been voiced by numerous lawmakers. The Bank of England has yet to formally start designing a digital pound, so it may be years away even though the UK’s Labour government has declared that it is committed to creating one, dubbed “Britcoin” informally. The European Union is currently debating whether to move forward with a digital euro while in the midst of what it refers to as a two-year “preparation phase.” The integration of offline payment capabilities into smartphones is receiving special attention. There, officials have issued a warning that the plans might still be shelved.

The Challenges of Creating a CBDC

You might be asking yourself at this point, “Why is everything taking so long?” Well… in short, creating an electronic version of an official fiat currency from scratch isn’t easy.A CBDC must be carefully designed to function well in remote locations without internet access. In addition, the infrastructure must be compatible with current systems and provide security measures in case of a cyberattack. Although blockchains have been the foundation for some of these digital assets, there are worries that these networks might not be able to manage a high volume of daily transactions while maintaining low costs. Customers who may not be familiar with digital wallets will also find it challenging to learn, so they will want reassurance that their privacy will be equivalent to that of cash. Additionally, there is concern that CBDCs might inadvertently exacerbate economic instability, particularly if they eliminate the role of commercial banks. Lending to consumers is a critical function of financial institutions, particularly in the case of mortgages. This business model could be compromised by a switch to CBDCs, which would also increase the risk of bank runs.

What Makes CBDCs Different From Cryptocurrencies?

Certain central bank digital currencies may use the same infrastructure as altcoins, but there are still significant differences between the two. They include:

- Centralization: As the name suggests, CBDCs are issued by centralized authorities who retain full control, meaning their supply can scale up or down when needed. Meanwhile, cryptocurrencies like Bitcoin are decentralized. This means no single person is in charge, with the number of BTC that will ever exist fixed at 21 million.

- Stability: A CBDC is always pegged on a one-to-one basis with the fiat currency it represents. Meanwhile, cryptocurrencies are famed for their volatility and can fluctuate wildly in price. While stablecoins are pretty similar to CBDCs, they aren’t official — and during past incidents of market turbulence, they’ve ended up being worth less than $1.

- Legal tender: More than 15 years after launch, Bitcoin isn’t widely accepted as a payment method — with El Salvador and the Central African Republic the only two countries where it has officially become legal tender. By default, CBDCs will be granted this status by default.

- Permissioned blockchains: CBDCs typically run on centralized networks with a small number of people who have been granted permission to participate, delivering cryptographic security without compromising on control. By contrast, anyone can join a permissionless blockchain like Bitcoin and Ethereum without restriction.

Pros and Cons for Consumers

We still do not fully understand the range of potential applications for CBDCs, which means they are still very much in the experimental stage of digital asset development. However, some distinct advantages and disadvantages have already begun to surface.

Advantages

- Faster transactions: Whereas some payments can take several business days to clear, CBDC transfers could be settled instantaneously.

- Cheaper international payments: CBDCs could be especially useful for remittances, where foreign workers send cash back home to their loved ones. This currently attracts an average global fee of 6.35% — eating into incomes — but a central bank digital currency could dramatically reduce this.

- Greater levels of automation: In time, CBDC infrastructure could allow tax to be collected automatically, reducing evasion and minimizing stress for consumers. Programmable payments would mean a CBDC can only be spent on specific purposes, such as food or childcare, with funds released if certain conditions are met.

Disadvantages

- Greater surveillance: If Alice hands Bob a $20 note in the street, no one would necessarily know that transaction took place. But if this same $20 was transferred from one CBDC to another, the payment may no longer be anonymous. Central banks have been seeking to reassure the public that privacy-preserving measures will be enforced.

- Restrictions: Many CBDCs impose limits on the total balance that a single consumer may have, while others also don’t offer interest on savings. This can deter adoption because funds would be gradually eroded by inflation over time.

- Cash under threat: There are concerns that CBDCs could eventually lead to physical coins and banknotes being phased out of the economy. Older consumers who lack the technical knowhow to operate a digital wallet would be hardest hit — but most central banks have insisted that both cash and CBDCs will operate alongside each other.

Criticism of CBDCs

Politicians that support libertarian ideologies and Bitcoin maximalists have expressed concern about the growing popularity of CBDCs because they believe they could be used to restrict spending. Unfounded rumors suggest that a CBDC could prohibit the sale of alcohol after 1 a.m., restrict the amount of red meat that can be purchased, or limit the number of flights an individual can take annually to address climate change. These scenarios are meant to show how these digital assets could reduce financial freedoms, even though there is no proof that any of this is happening or will happen in the future. The need for central bank digital currencies has also been openly questioned by detractors, who contend that there are not many real benefits to using them over the existing payment methods. This implies governments may have a difficult time introducing CBDCs across the country, especially since many consumers are not even aware of them. The emergence of more CBDCs will make the next ten years noteworthy. However, the shift might not go smoothly, and some nations might decide it is not worth the trouble.

1 Comment