Get your daily, digestible dose of news about blockchain and cryptocurrencies today. Explore the stories that are going unnoticed in the mainstream media.

In crypto news today:

- Why is Crypto Down Today?

- Bitcoin Recouples with Equities as Positive Correlation Strengthens – Bitfinex

- SOON Raises Cobuilder Round from Industry Leaders in Solana Labs, Coinbase Ventures and More

- Thai Authorities Raid Illegal Bitcoin Mine

__________

Why Is Crypto Down Today?

The value of the worldwide cryptocurrency market dropped 2.8% to $2.3 trillion in the last day.

$79.4 billion worth of cryptocurrency was traded in the previous day.

Very few coins are in the green territory today.

Helium (HNT) is the best performer among the top 100, with a 12.6% increase to $7.09.

It’s followed by Akash Network (AKT)’s 12% increase to $2.99, as well as Artificial Superintelligence Alliance (FET)’s 9.5 rise to $1.43.

The remaining eleven green coins are up 2% and below.

On the red side, we find Notcoin (NOT) with the biggest loss. It fell 9.3% to $0.008655.

And while PEPE decreased around 5%, the rest are down some 4% and below.

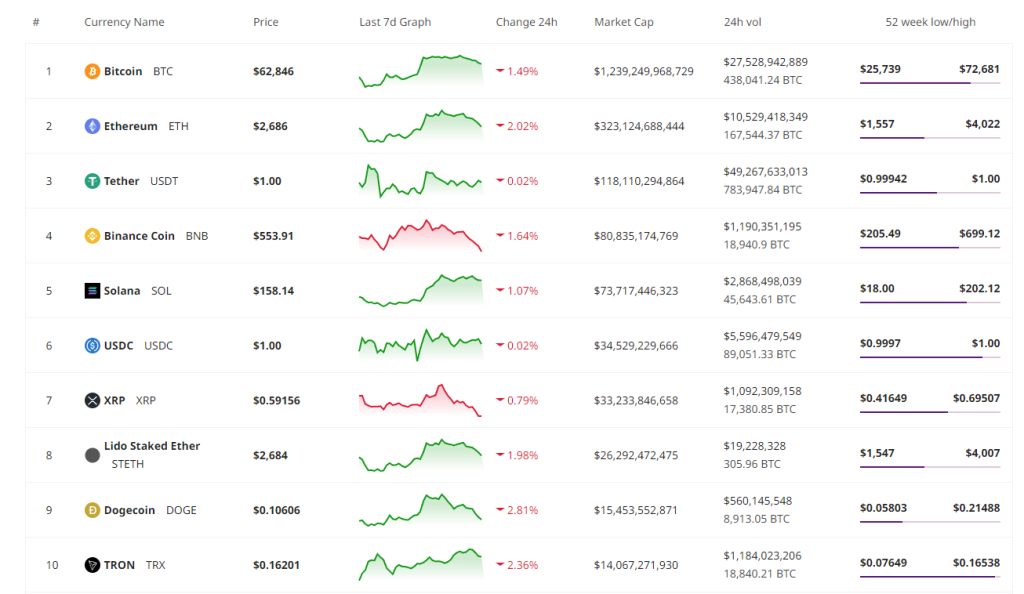

As for the top 10 coins per market cap, they are all red.

Dogecoin (DOGE) recorded the biggest loss of 2.8%, trading at $0.10606.

Tron (TRX) is now far behind, having seen a 2.4% fall to the price of $0.16201.

At the same time, Bitcoin (BTC) dropped the least. It is down 1.5%, currently changing hands at $62,846.

Ethereum (ETH)’s price at the time of writing is $2,686 after it decreased by 2%.

In the meantime, earlier today’s market reaction followed rumors that the US Federal Reserve might lower interest rates in September.

Furthermore, Defiance’s new single-stock long-leveraged MicroStrategy exchange-traded fund (ETF) saw $127 million inflows in six days.

Bitcoin Recouples with Equities as Positive Correlation Strengthens – Bitfinex

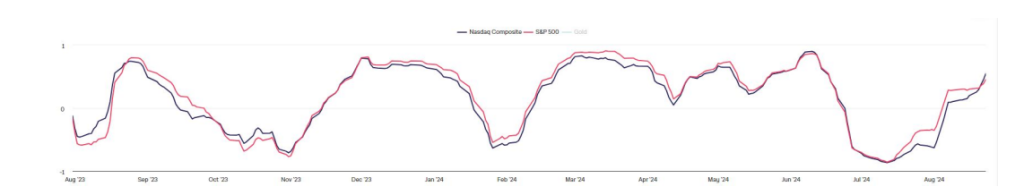

According to cryptocurrency news today, last week saw a surge in the price of Bitcoin to $65,000, and riskier assets as a whole saw a rise in value after US Federal Reserve Chair Jerome Powell hinted at a possible September rate cut.

As stocks increased, Bitfinex analysts noticed that Bitcoin experienced its second-largest daily move since May.

Notably, this move “restored the positive correlation between the two assets,” with the analysts seeing this as “a sign of returning risk appetite in the market.”

As per the most recent Bitfinex Alpha Market Report, there was a correlation between the equity market and the rally.

The Pearson Correlation measures the relative correlation of BTC with the SPX and the NASDAQ on a 30-day rolling basis. It shows an increase in correlation since July 12.

SPX daily chart:

But since the August 5 capitulation low, Bitcoin has been “relatively weaker” in comparison to stocks, according to the analysts.

With the complete distribution of Bitcoins seized by German law enforcement and the nearly complete Mt. Gox distribution, they contended that “the market is clearly exhibiting a risk-on sentiment, encouraged by the apparent imminence of rate cuts, and the current lack of overhang.”

Bitcoin Pearson correlation with S&P500 and the NASDAQ composite:

Bitfinex analysts also noted in an email to Cryptonews that “the directional open interest in the market has decreased, potentially allowing more room for price appreciation in Bitcoin and altcoins, as interest in delta-neutral and funding arbitrage trades rises.”

SOON Raises Cobuilder Round from Industry Leaders in Solana Labs, Coinbase Ventures and More

A cobuilder round has been raised by SOON (Solana Optimistic Network) that is only open to builders and does not involve venture capital firms.

It received funds from Lily Liu, Chairman of Solana Foundation; Anatoly “Toly” Yakovenko, co-founder of Solana Labs; Jonathan King, Principal at Coinbase Ventures; Mustafa Al-Bassam, co-founder of Celestia Labs; Amrit Kumar, Co-founder of AltLayer; Prabal Banerjee, co-founder of Avail; and Robinson Burkey, co-founder of Wormhole Foundation.

According to the press release shared with Cryptonews, other notable builders in the round include Matt Katz, co-founder at Caldera; Jed Halfon, CSO at Anza; Kartik, co-founder at ETHGlobal; Victor Ji, co-founder at Manta Network; Mable Jiang, Chief Revenue Officer of StepN; Dani Osorio, ETHDenver Content Lead and Partner at Metaweb; Alex Pruden, Executive Director at Aleo Foundation, and more.

“Decouple, then to the infinity.”

— SOON – Solana Optimistic Network (@soon_svm) August 26, 2024

Tomorrow is the day. pic.twitter.com/hifGF4W5z0

It said it would use the funds to build its flagship products: SOON Stack and SOON Mainnet.

The Solana Virtual Machine (SVM) and OP Stack are combined into the modular framework known as SOON Stack. It will enable the deployment of an SVM Layer 2 on any Layer 1 in order to boost ecosystem throughput overall and maintain cheap fees.

A general-purpose SVM Layer 2 solution, SOON Mainnet is implemented via the SOON Stack and settles on the Ethereum blockchain. According to the team, it will boost the Ethereum ecosystem’s transaction per second (TPS) capacity by 650K TPS.

The team’s goal is “to combine the power engine of Solana, SVM with liquidity and user base from other L1s, and to make SVM the standard for every L1 ecosystem,” according to Joanna Zeng, co-founder and CEO of SOON.

Thai Authorities Raid Illegal Bitcoin Mine

Today’s other cryptocurrency news included the raid of an illegal Bitcoin mine in Ratchaburi, a province west of Bangkok, by Thai Police and Provincial Electricity Authority (PEA) officials.

This comes after residents complained of repeated blackouts for more than a month, according to the South China Morning Post, citing local authorities.

Not to mention that it was the fourth raid of this kind in the same province this year alone.

According to the report, Bitcoin miners are regarded as manufacturers in Thailand. As a result, they have taxes to pay.

🚨 **Breaking News!** Thai authorities just raided an illegal #Bitcoin mine in Ratchaburi causing power outages! 🕵️♂️💡

— John Bravo (@JohnBTCBravo) August 26, 2024

– Residents' complaints lead to action 📣

– Massive power consumption by mining rigs uncovered 🖥️⚡

– Equipment seized but the operation was mostly moved before… pic.twitter.com/HHIv21DfTU

Chief district security officer Jamnong Chanwong stated that the discovery of Bitcoin mining rigs by the authorities “points to people using this house to operate a mine and using power they did not fully pay for.”

He said that even though there was a large amount of electricity consumed, not much of it was paid for.

Notably, on Thursday, there was an attempt to break into the house. Authorities obtained a search warrant after a guard refused to let them in, but it was claimed that most of the equipment had been relocated.

Leave a Reply