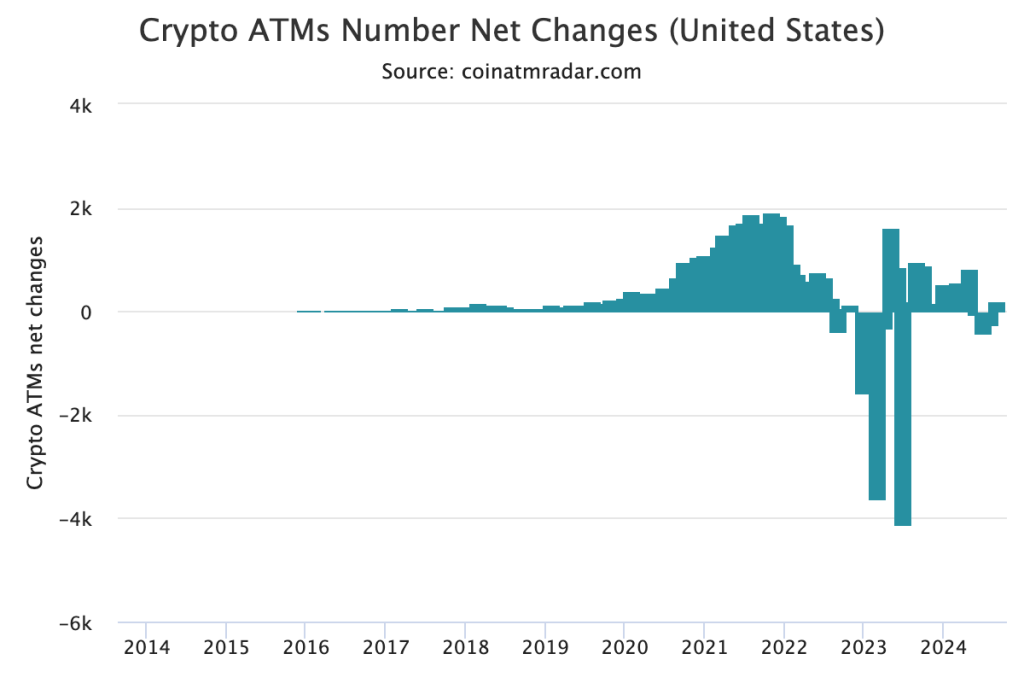

Globally, more than 600 Bitcoin ATMs were closed, with the US losing the most (411 ATMs in July and 258 in August).

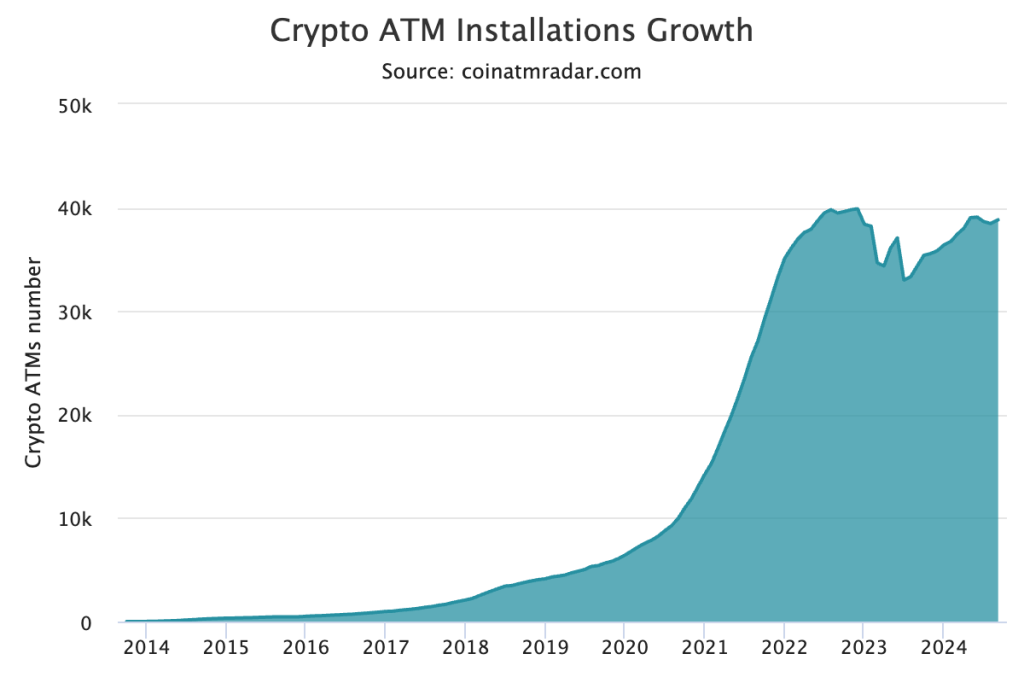

In the first two months of Q3 2024, over 600 Bitcoin ATMs were taken offline as part of a global crackdown on cryptocurrency ATMs, with the United States leading the charge.

Because these machines are involved in illegal activities like extortion and scams, authorities are focusing on them more and more.

Coin ATM Radar data shows a significant decline in the global Bitcoin ATM network, with a loss of 435 machines in July and 182 in August. The United States contributed the most to these figures, reporting a reduction of 411 ATMs in July and 258 in August.

Over $100 Million Lost to Bitcoin ATMs Scam, Victims Mostly Older People

The increase in Bitcoin ATM closures is a result of a larger drive by regulatory and law enforcement agencies to combat financial crimes that are made possible by these devices.

A local government committee in Chico, California, is proposing to treat Bitcoin ATMs like banks in order to more strictly regulate these devices.

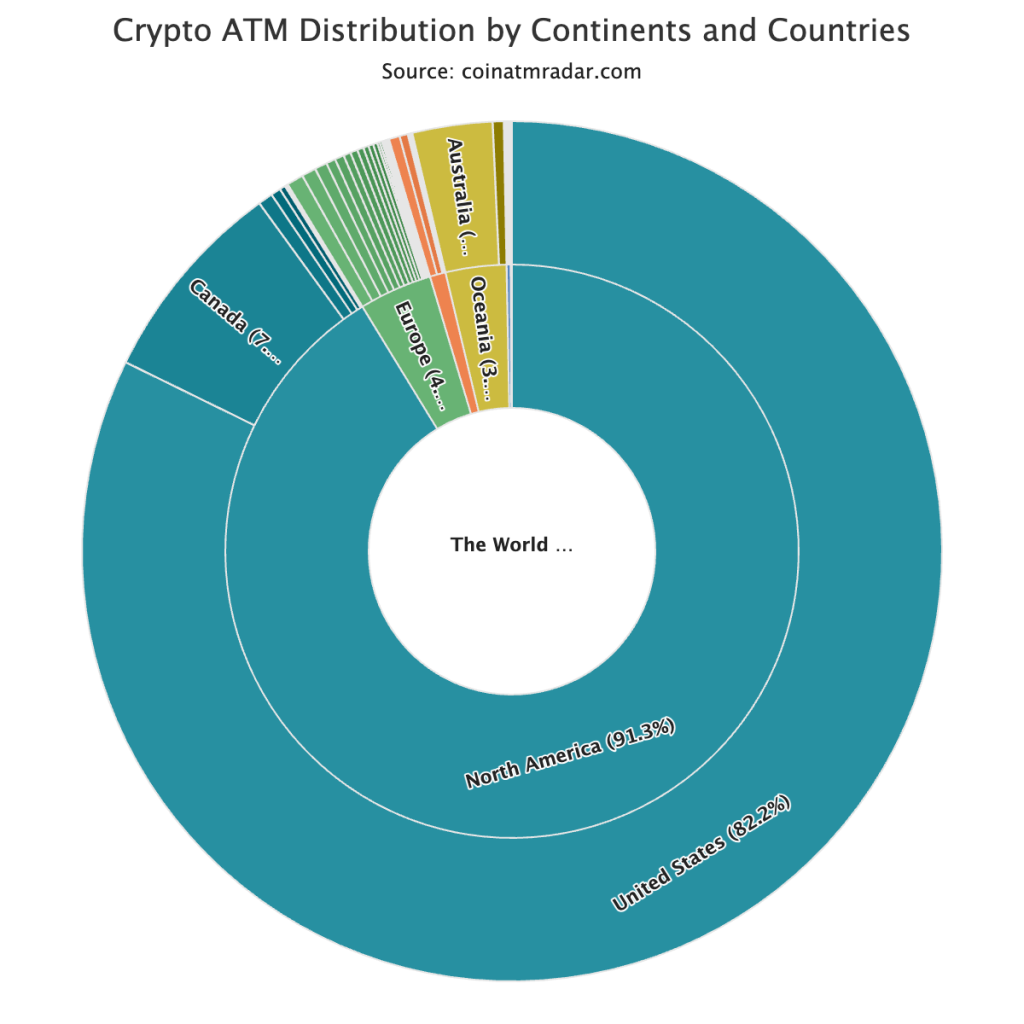

Because the majority of Bitcoin ATMs are stationed there, the Federal Trade Commission (FTC) of the United States has reported a startling tenfold increase in scams involving these machines since 2020.

These scams take advantage of the speed and anonymity of cryptocurrency transactions, enabling con artists to trick people into sending money through Bitcoin ATMs on false pretenses.

Losses from these scams topped $110 million in 2023 alone, and the likelihood of seniors 60 years of age and above being the target is three times higher.

According to a recent report, scammers are increasingly using cryptocurrency ATMs and kiosks as a means of tricking unsuspecting people. One such example is a case in which a Troy, Michigan woman lost almost $5,000.

An email claiming an unintentional overpayment served as the bait for the scam. After that, the victim used cash to fund a Bitcoin ATM and bought the con artists gift cards.

These ATMs convert cash deposits into digital currency, which makes it simple for con artists to transfer money to accounts that are frequently located abroad.

In 2023, the FBI received over 2,000 complaints about cryptocurrency ATMs, mostly from people over 60.

International Crackdowns On Bitcoin ATMs: Beyond US Alone

The regulatory scrutiny of crypto ATMs is not limited to the United States.

In a decisive crackdown on August 20, Germany’s Federal Financial Supervisory Authority (BaFin) seized 13 crypto ATMs from 35 locations.

Without adequate Know Your Customer (KYC) controls, German authorities fear that these machines could become hubs for criminal activity, especially when it comes to transactions exceeding 10,000 euros.

Comparably, as part of a larger plan to control public promotion of cryptocurrencies, the Monetary Authority of Singapore (MAS) has gone one step further and completely outlawed cryptocurrency ATMs in Singapore.

These regulatory measures will have a big effect on the cryptocurrency ATM market, which presently has about 38,790 machines operating globally. Together, the US and Canada make up roughly 91% of the entire network.

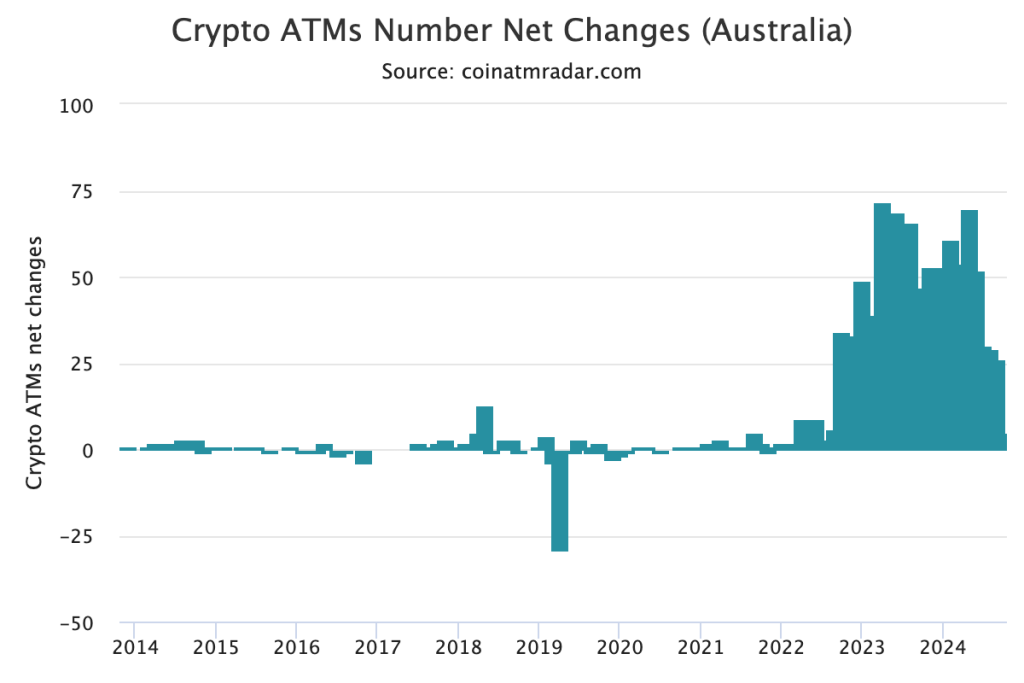

28,691 of these machines, or 74% of the worldwide market, are owned by the top 10 operators, demonstrating the highly concentrated nature of this sector. In fact, more than 1000 Bitcoin ATMs are currently located in Australia, according to a recent report from earlier this year.

Are the Regulators Preventing Crimes, or They Are Curbing Crypto Adoption? Expert Insight

Experts in the field contend that closing Bitcoin ATMs could make it more difficult for people to access cryptocurrency, particularly for those who depend on them to transact in digital assets.

They expressed their worries about the effects of closing Bitcoin ATMs and emphasized how crucial these devices are in giving people who might not otherwise have access to cryptocurrencies a way to transact with them.

Co-founder of XYO Network Markus Levin expressed disapproval of the crackdown by saying,

“Bitcoin ATMs are amazing. They give people a way to get exposure to crypto, especially for those who might not otherwise have that access, and to shut them down is ridiculous. Nobody would shut down cash ATMs.”

Levin is adamant that rather than addressing legitimate criminal concerns, regulatory actions may be more about managing the expansion of the cryptocurrency market.

Similar views were expressed by Brian D. Evans, CEO and founder of BDE Ventures, who highlighted the potential advantages of Bitcoin ATMs as an essential on-ramp for digital assets.

“I think Bitcoin ATMs are useful for the industry, and I’m not sure the criminal activity claims are valid. Any on-off ramp is good for Bitcoin and crypto and for people to get access to these assets. In the long run, people should just be accepting crypto directly. But these ATMs could be a good solution to getting access when we don’t have solid regulation in place for more people to get access to Bitcoin and crypto.”

Evans thought that the industry’s larger worry was that rather than the machines being connected to criminal activity, authorities’ reluctance to fully embrace cryptocurrencies may be the reason behind regulatory actions taken against Bitcoin ATMs.

Notably, operators like Bitcoin Depot—which operates 8,512 ATMs worldwide, or 21.9% of the total—are taking preventative action. To warn customers about possible fraud, the company has added screen prompts and scam warnings to its kiosks.

However, given the rising number of scam incidents, the efficacy of these measures is still being questioned.

However, if it is put into practice successfully, it might result in a more balanced strategy, as the experts have recommended, with improved laws and technological fixes that might work better than outright prohibitions.

Leave a Reply