Stablecoin adoption in the United States has slowed, according to a Chainalysis report, as more transactions are being routed to international markets due to regulatory uncertainty.

In contrast to international markets, the adoption of stablecoins in the United States has slowed in 2024, per a report released on October 17 by Chainalysis, a blockchain analysis company.

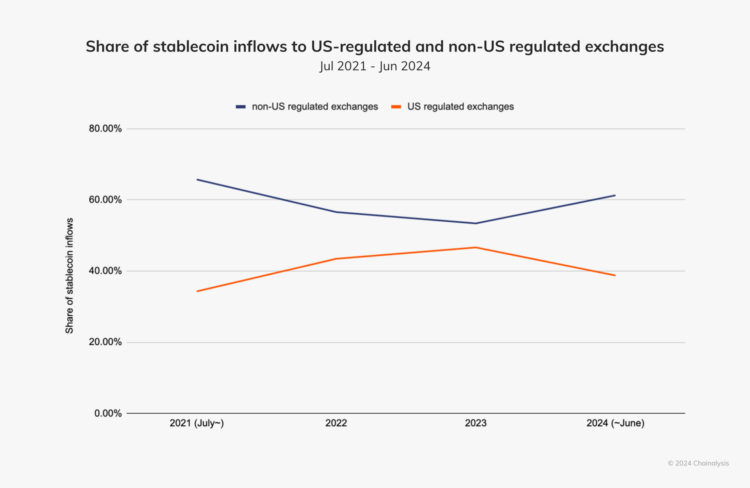

The study points out that although the use of stablecoins has increased globally, the percentage of stablecoin transactions in the US market has decreased, falling from roughly 50% in 2023 to less than 40% in 2024.

Global Stablecoin Adoption Outpaces the U.S.

As per the report, this slowdown in adopting stablecoin in the U.S. is largely attributed to the lack of regulatory clarity.

According to Chainalysis, the U.S. has not made as much regulatory progress as other regions in the realm of digital assets, especially stablecoins, which has caused adoption to stagnate.

Global stablecoin markets have seen a rise in adoption, whereas the U.S. stablecoin market is declining relative to other markets.

Stablecoin growth over the past month shows two particularly interesting things:

— David Alexander II (@Mega_Fund) October 16, 2024

(1) USDC ($960M) circulating supply outpaced Tether ($793M) and

(2) PYUSD circulating supply on Solana is down 36% as users are reverting back to baseline behaviors since incentives for using it… pic.twitter.com/3GZUvQz6A5

More transactions are now taking place on non-U.S.-regulated exchanges, reflecting a growing demand for stablecoins in emerging markets.

Stablecoins’ capacity to provide a reliable store of value in areas with unstable currencies and restricted access to US dollars is what is fueling this boom.

Stablecoins allow the local populace to access US dollar stability without relying on conventional banking institutions.

U.S. Regulatory Uncertainty and Global Competition

Chainalysis further highlighted that a significant portion of the U.S. slowdown in stablecoin adoption can be attributed to regulatory uncertainty.

Stablecoin regulation in the United States is a challenge, in contrast to other regions like the United Arab Emirates, Singapore, Hong Kong, and the European Union, where clear regulatory frameworks have been enacted to support the growth of digital assets.

Additionally, the European Union’s Markets in Crypto-Assets Regulation (MiCA), implemented in June 2024, has provided much-needed clarity for stablecoins in Europe, attracting projects and fostering adoption.

In the meantime, Circle cautions that the United States may lose its dominance in dollar-based on-chain commerce as well as its influence in the stablecoin market in the absence of clear direction.

Although U.S. regulatory progress is slow, steps have been taken to create a stablecoin framework.

In July 2023, the House Financial Services Committee advanced a stablecoin bill aimed at providing regulatory clarity.

Circle is still upbeat and believes that Congress will approve the legislation defining precise anti-money laundering (AML) and sanctions requirements for stablecoin producers, guaranteeing the United States’ place in the world stablecoin market.

Leave a Reply