Bitcoin Price Analysis

Although it is currently losing some of its momentum, Bitcoin (BTC) is still trading in a bullish range, ranging from $69,000 to $70,000. It hit a record high above $73,000 earlier this week, but it was unable to hold that level and has since dipped, trading at about $69,671.

Bitcoin Traders Reach Six-Month Peak as Market Signals Suggest Bullish Trendhttps://t.co/Hh96oJWUy0

— £𝕞𝕕𝕖𝕖 (@Emdee_15) November 1, 2024

Despite this recent dip, there are signs that BTC could regain bullish traction.

Notably, a rise in the number of addresses holding Bitcoin for less than 30 days has caused the trading volume to soar to a six-month high.

This points to a developing bullish mood reminiscent of earlier market rallies. Even with the recent price declines, traders’ optimism is growing, as evidenced by the increase in open interest in derivatives.

🚨 MicroStrategy moved 1,652 BTC (approx. $114M) to a new wallet address just hours ago.

— Satoshi Club (@esatoshiclub) November 2, 2024

The company holds 252,220 $BTC (valued at $17.56B) with an average buy price of $39,266, sitting on unrealized gains of $7.65B. pic.twitter.com/amRxiWBNAe

In addition, traders took notice when MicroStrategy, the biggest corporate Bitcoin holder, transferred 1,652 BTC to a new wallet.

The company wants to raise $42 billion for future Bitcoin purchases and currently has 252,220 BTC worth about $17.56 billion.

This might be a sign of higher demand, which could encourage market optimism. As traders react to corporate interest, such a move might put upward pressure on the price of Bitcoin.

Bitcoin Trading Volume Hits Six-Month High, Signals Bullish Momentum

As more addresses now own Bitcoin, many of which belong to investors who purchased within the last 30 days, the price of the cryptocurrency recently hit a six-month high, indicating renewed interest.

Blockchain analytics company IntoTheBlock claims that this pattern is frequently linked to previous bull markets, such as those in 2017 and 2020–2021, indicating that traders anticipate price increases.

Rising open interest in the derivatives market indicates more active contracts, which indicates that traders are confident in the potential price of Bitcoin. Short-term accumulation combined with increased trading activity suggests that market sentiment is changing.

- Key Takeaways:

- Bitcoin trading volume and address holdings are up.

- Derivatives market shows increased open interest.

- Positive sentiment hints at potential BTC price increase.

While this trend indicates growing demand, its impact on BTC’s long-term price remains to be seen.

MicroStrategy’s $42B Bitcoin Plan Sparks Market Optimism

Investors took notice when MicroStrategy, the biggest corporate Bitcoin holder, recently moved 1,652 BTC to a new wallet.

Having acquired 252,220 Bitcoin at an average price of $39,266 and valued at approximately $17.56 billion, the business has an unrealized profit of $7.65 billion.

This transfer fits in with MicroStrategy’s ambitious “21/21 Plan” to leverage $21 billion in equity and $21 billion in fixed-income securities to raise $42 billion over three years.

🚨 MicroStrategy moved 1,652 BTC (approx. $114M) to a new wallet address just hours ago.

— Satoshi Club (@esatoshiclub) November 2, 2024

The company holds 252,220 $BTC (valued at $17.56B) with an average buy price of $39,266, sitting on unrealized gains of $7.65B. pic.twitter.com/amRxiWBNAe

Working with banks to obtain the funding, MicroStrategy also hopes to use these funds to increase the size of its Bitcoin holdings. This tactic demonstrates their faith in Bitcoin’s long-term growth and commitment to its potential.

- Key Insights:

- 1,652 BTC transferred, reinforcing market interest.

- 21/21 Plan aims to raise $42 billion for future BTC buys.

- Institutional demand likely to support BTC price momentum.

This plan may boost market confidence, signaling strong institutional backing for Bitcoin.

Bitcoin Holds Key 61.8% Fibonacci Level, Signals Potential Rebound

After hitting a crucial Fibonacci support level at $68,850, Bitcoin (BTC) has retraced 61.8% from its most recent high of $73,800. Technicals suggest a potential bounce, making this level a potential pivot point.

With subsequent resistance levels at $71,830 and $73,800, the immediate resistance is located at $70,640.

Bitcoin might find additional support at $67,280 and $65,550 if it is unable to maintain above the $68,850 support.

Technical indicators suggest a cautious outlook.

The Relative Strength Index (RSI) is near 45, indicating neutral momentum, while BTC hovers around the 50-period Exponential Moving Average (EMA) at $69,610. A close above the EMA could signal renewed bullish strength.

Key Insights:

- Bitcoin completed a 61.8% Fibonacci retracement at $68,850.

- RSI around 45 indicates balanced buying and selling pressure.

- A close above $70,640 may solidify a bullish reversal.

Join the Epic FreeDum Fighters Showdown: MAGATRON vs. Kamacop!

Join the satirical token project FreeDum Fighters, which transforms the US election into an exciting battle royale! Mechanized leaders Kamacop 9000 and MAGATRON compete against one another. Depending on your preferred side, you can stake, earn points, and receive rewards with $DUM tokens.

There are two reward pools in FreeDum Fighters: Kamacop stakers get larger payouts if MAGATRON wins, and MAGATRON stakers gain more if Kamacop wins.

You can “inflate egos” and support your side in this virtual showdown by participating in weekly debates and community events.

Presale is open and you can get $DUM early.

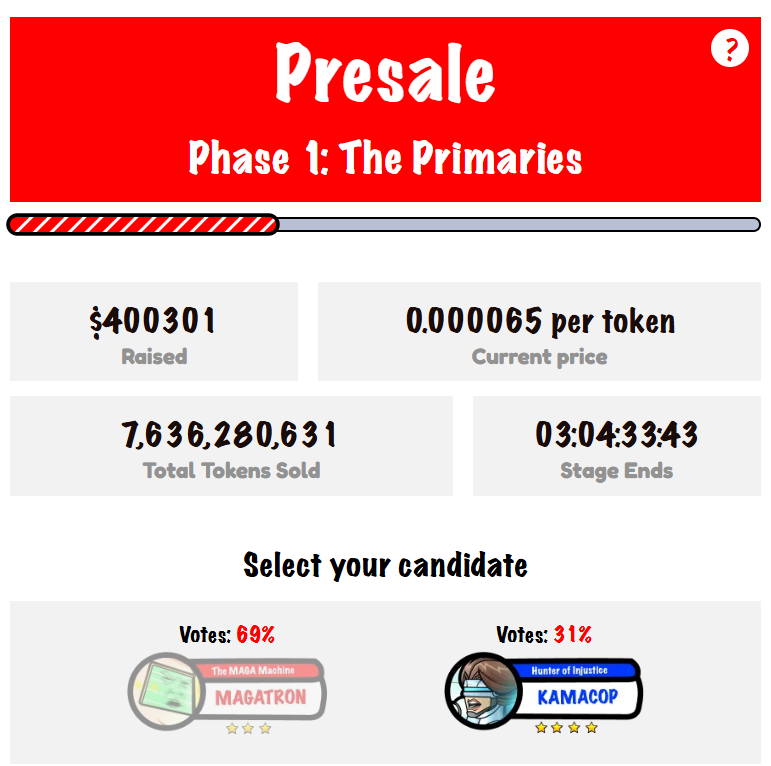

Presale – Phase 1: The Primaries

- Raised: $400,301

- Current Price: $0.000065 per token

- Tokens Sold: 7.64 billion and counting

- Stage Ends In: 03 days

- Candidate Support: MAGATRON – 69%, Kamacop – 31%

Don’t miss your chance to get $DUM tokens early and back your fighter in this satirical political theater!

Leave a Reply