Inflows triggered by the continued expectations of dovish monetary policy in the US.

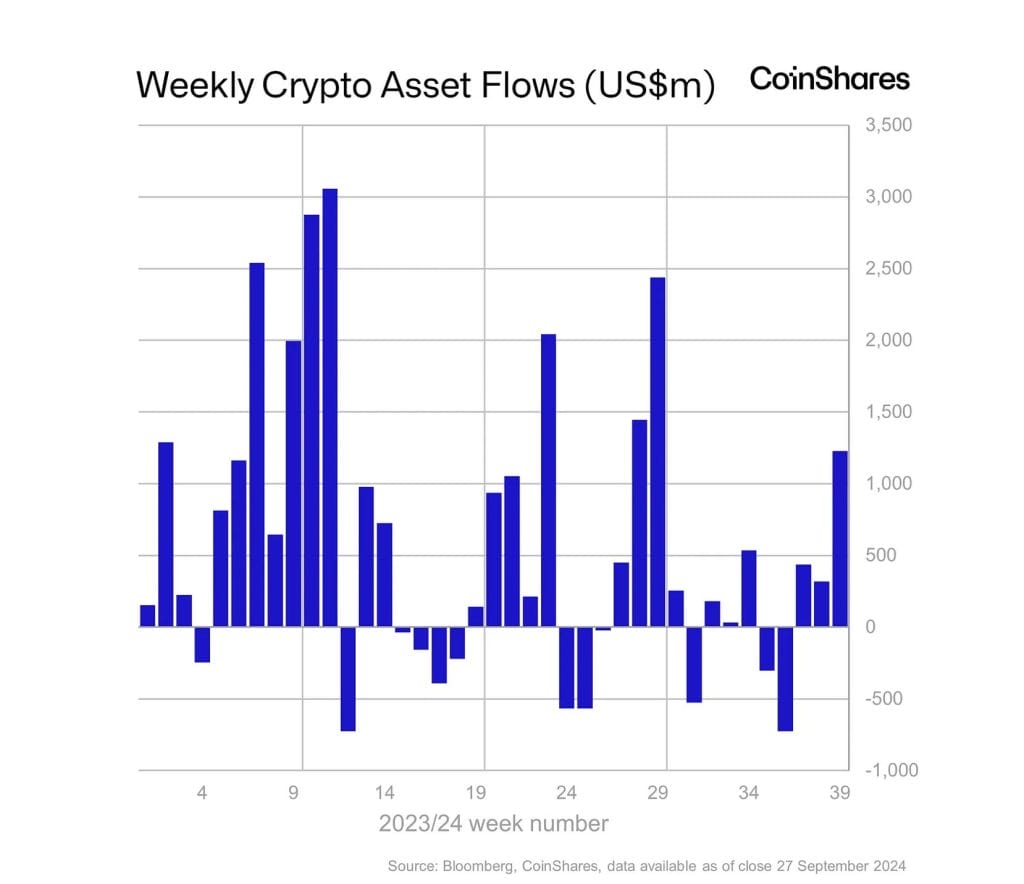

According to CoinShares, investors in digital asset products have poured $1.2 billion into them for a third week running, driven by ongoing expectations of dovish US monetary policy.

The positive price momentum of digital assets and market expectations of dovish monetary policy from the US Federal Reserve are driving trading activity.

Last week, there was a noteworthy 6.2% increase in the total assets under management (AuM) of digital asset products, which is indicative of increased investor confidence and market optimism.

According to CoinShares research analyst James Butterfill’s report, one of the things that contributed to the positive sentiment was the approval of options for some U.S.-based digital investment products, which probably encouraged more inflows.

Trading volumes showed a slight decline, down 3.1% from the previous week, despite this growing interest. The disparity between higher investment and lower trading activity could indicate that investors are being cautiously optimistic and are holding off on increasing trading volumes until they receive stronger signals.

Regional Breakdown: U.S. And Switzerland See Huge Inflows

There was disagreement in the region over digital assets. Switzerland and the United States emerged as major participants, with inflows of $84 million and $1.2 billion, respectively.

Specifically, Switzerland saw the highest inflows since the middle of 2022, indicating a rise in demand for digital assets throughout European markets. However, there were withdrawals from Brazil and Germany totaling $21 million and $3 million, respectively, suggesting that investor sentiment varies by region.

With $1 billion in inflows, Bitcoin—the biggest cryptocurrency by market capitalization—benefited most from these inflows. Interest in short-bitcoin investment products increased along with the rise in bitcoin inflows, resulting in $8.8 million in inflows.

Although there is still optimism regarding Bitcoin overall, some investors are continuing to hedge their positions in anticipation of future price corrections.

The second-largest cryptocurrency, Ethereum, saw inflows of $87 million, ending a five-week trend of withdrawals and indicating a recovery in investor confidence. For Ethereum, these are the first sizable inflows since early August. Nevertheless, $4.8 million in withdrawals from Solana, a significant cryptocurrency, indicated that it was still having problems.

Altcoin performance was inconsistent. Positive inflows were seen for XRP ($0.8 million) and Litecoin ($2 million), respectively. According to CoinShares, Binance and Stacks experienced withdrawals of $1.2 million and $0.9 million, respectively, illustrating the overall unpredictability and volatility that persist in the altcoin market.

Leave a Reply