The goal of recent changes is to increase transaction efficiency, and TFL intends to burn every coin. This might have a favorable effect on both the price and supply of Terra Luna Classic.

Over the past month and a half, the price of Terra Luna Classic has been steadily rising, indicating the project’s potential to reach earlier yearly highs. As the Terra Luna Classic community awaits the Chapter 11 bankruptcy hearing, today is very important. Moreover, rumors of a prospective cryptocurrency rally have been sparked by the U.S. Fed’s recent decision to lower interest rates by 0.50%. Will the price of LUNC make a return?

Bankruptcy Hearing Could Supercharge Terra Luna Classic Price

Terraform Labs (TFL), the company behind the Terra ecosystem, announced its Chapter 11 bankruptcy hearing will begin on September 19 after confirming the dates.

Important Notice for the Terra Community regarding the Plan Confirmation Hearing:

— Terra 🌍 Powered by LUNA 🌕 (@terra_money) August 21, 2024

The Plan Confirmation Hearing in the Chapter 11 bankruptcy cases of Terraform Labs Pte Ltd (TFL) and Terraform Labs Limited (TLL) has been set to September 19, 2024 at 10:00 a.m. (ET).

For more…

The hearing will enable the company to restructure and is essential to the closure of Terraform Labs Ptw Ltd and Terraform Labs Limited. The TFL agreed to pay $4.5 billion in compensation and started the liquidation process with the signing of the agreement with the SEC.

By October 30, 2024, TFL, as a company, will have burned all of its coins, including LUNC and USTC.

Meanwhile, the Terra Luna Classic chain finished updating to version 3.1.5, which should address issues with transaction efficiency, wasmd, and readiness for the Tax2Gas rollout.

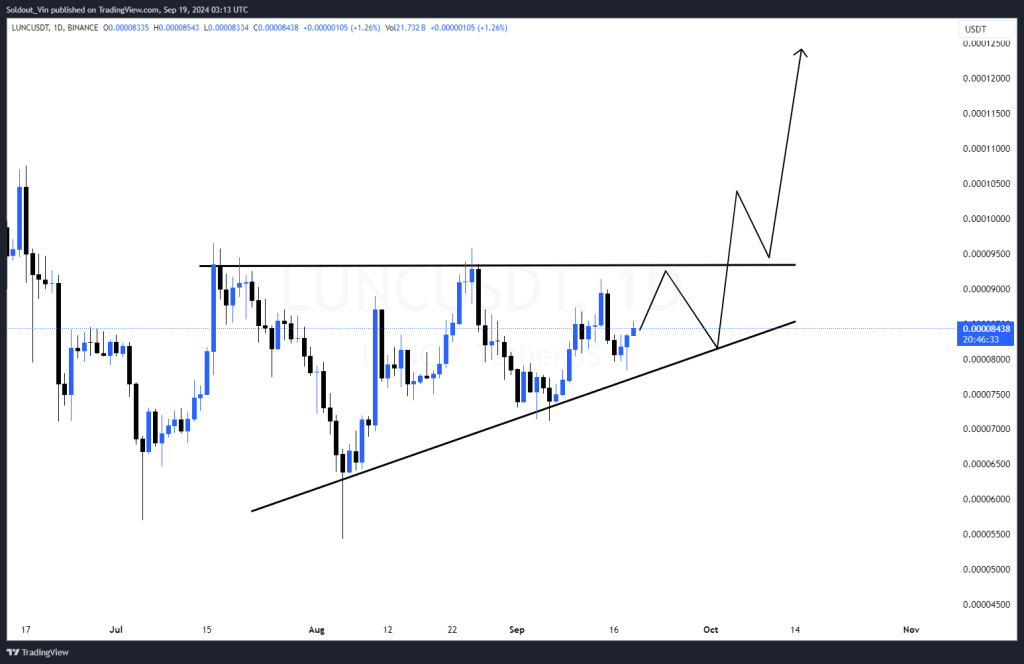

In the past day, the price of LUNC has risen by 2.2% and is currently trading at $0.00008452. Before the hearing, a bullish pattern is beginning to emerge on the daily time frame chart, which could cause the price of Terra Luna Classic to rise by 50%.

LUNC Price Analysis: $0.000013 Next If This Resistance Breaks

The price action of Terra Luna Classic demonstrates an upward trend that began in early August. The support’s upward slope points to a short-term bullish trend. With a stronger support at $0.000075, the ascending trendline, which is presently at $0.000080, is a significant dynamic support.

Conversely, despite numerous tests, the horizontal resistance at $0.000095 has not yet been broken. It continues to be the primary obstacle to bullish continuation. If the breakout above $0.000095 takes place, then long-term targets between $0.000120 and $0.000135 could be reached above that.

The price of Terra Luna Classic seems to be forming an ascending triangle-shaped bullish continuation pattern. If the price closes above $0.000095 with greater volume, the higher lows against the horizontal resistance indicate that a breakout to the upside is probably imminent.

For long-term holders, any pullbacks in the vicinity of the rising trendline are excellent accumulation opportunities because they represent a lower-risk entry point.

The present bullish configuration would be invalidated and new lower targets would be set around $0.000075, $0.000065, and $0.000054 if the LUNC price breaks below this level of $0.000080.

Leave a Reply