In order to adhere to the European Union’s Markets in Crypto-Assets (MiCA) regulation, the Cardano Foundation and the Crypto Carbon Ratings Institute (CCRI) have published a set of sustainability indicators. This initiative sets a new standard for the EU’s larger crypto industry by demonstrating Cardano’s dedication to sustainability, transparency, and regulatory compliance among comparable service providers.

Cardano’s Sustainability Report Aligns with MiCA Regulations

Today, July 2, the Crypto Carbon Ratings Institute (CCRI) released a comprehensive report on Cardano, aligning with the Markets in Crypto-Assets (MiCA) mandate, which requires crypto asset issuers and service providers to disclose sustainability indicators. This compliance complies with MiCA’s Article 6 (1) and Article 66 (5), which require token issuers and crypto-asset service providers to provide comprehensive environmental impact information.

To guarantee strict blockchain monitoring and data collection, CCRI partnered with the Cardano Foundation, which is in charge of the ADA cryptocurrency. By using an energy-efficient consensus protocol, Cardano has demonstrated its dedication to sustainability, according to the CCRI report.

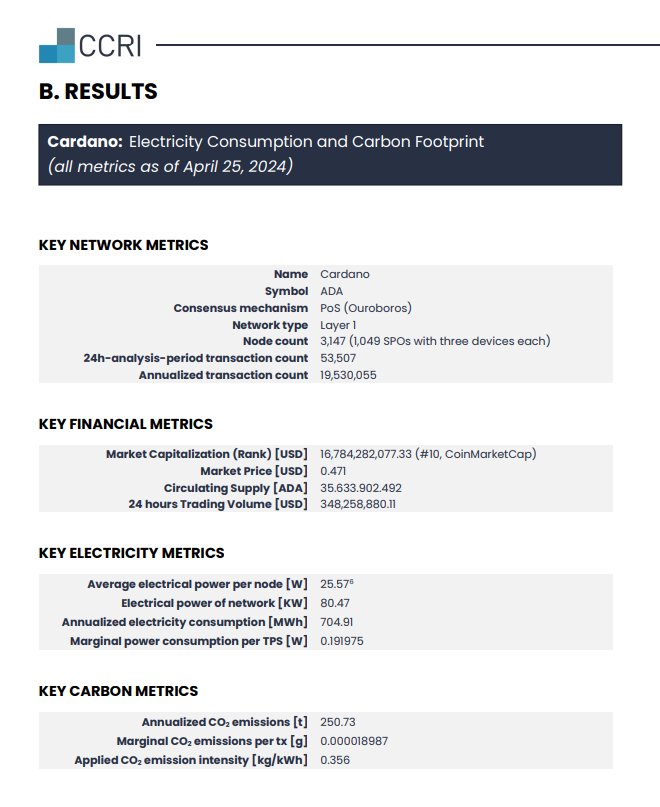

Cardano uses substantially less electricity to function than energy-intensive Proof of Work (PoW) protocols like Bitcoin. The network’s total yearly electricity consumption as of May 2024 is 704.91 MWh. The report states:

“Cardano employs an energy-efficient consensus protocol. In comparison to Proof of Work (PoW)-based protocols such as Bitcoin, Cardano consumes significantly less electricity.”

In addition to electricity consumption, the report highlights the Cardano network’s carbon footprint and the marginal power demand per transaction per second as important metrics. Under the MiCA framework, these metrics align with the draft regulatory technical standards (RTS) established by the European Securities and Markets Authority (ESMA).

“In addition to electricity consumption and carbon footprint, we provide sustainability metrics in line with the draft regulatory technical standards (RTS) provided by the European Securities and Markets Authority (ESMA) in the second consultation package of the Markets in Crypto-Asset (MiCA) regulation.”

Ten required indicators for climate and environmental impacts—including energy use, greenhouse gas emissions, waste generation, and the use of natural resources—are outlined in the ESMA’s second consultation package on MiCA, which was published on October 5, 2023. Transparency and regulatory compliance are guaranteed by CCRI’s adherence to these standards.

Frederik Gregaard, CEO of the Cardano Foundation, emphasized the importance of these efforts. He stated:

“By developing MiCA-compliant sustainability indicators, we aim to ensure adherence to the upcoming EU regulations and set a benchmark for the crypto industry. With the MiCA regulations partially coming into effect this week, the industry is now on a six-month countdown to implement crucial ESG binding requirements.”

Gregaard emphasized how these kinds of efforts help users, investors, and regulators develop trust, which in turn promotes the sustainable broader adoption of blockchain technology. He emphasized that this project shows how blockchain networks can effectively and transparently address environmental, social, and governance (ESG) issues.

MiCA’s Impact on Service Providers

Stablecoins are the subject of the first stage of MiCA regulations. Additional rules affecting crypto asset service providers will be introduced in December, which will have an effect on Cardano and other ecosystems. Other providers, such as Circle, have demonstrated this as well. As of July 1, Circle became the first stablecoin issuer in the world to receive an Electronic Money Institution (EMI) license under the MiCA regulatory framework. Circle can now issue its USDC and EURC stablecoins in Europe thanks to the license, putting the business in a strong position to take a sizable chunk of the European market. Similarly, Bitstamp responded to the EU’s MiCA regulation by announcing on June 26 that it would delist Euro Tether (EURT), Tether’s euro-pegged stablecoin. Bitstamp’s choice was also impacted by regulatory pressures, even though EURT’s market capitalization has significantly decreased from its peak of $236 million to about $33 million. In a similar vein, Binance, the biggest cryptocurrency exchange in terms of trading volume, limited access to specific stablecoins in the EU in order to adhere to the MiCA rule. Consequently, a number of current stablecoins might be subject to limitations. Binance intends to enable users who own “unauthorized” stablecoins to exchange them for fiat money, Bitcoin, Ether, or other digital assets. MiCA seeks to establish a unified regulatory framework for crypto assets in the EU, and it went into effect last month on June 30, 2024. Issuers of fiat-backed stablecoins are required to put strict security measures in place and guarantee complete backing by liquid reserves. According to this rule, the public can only access stablecoins issued by regulated businesses.

1 Comment