The companies that are driving the effort to maximize bitcoin holdings are Metaplanet, Cathedra Bitcoin, and MicroStrategy.

Cathedra Bitcoin pivots from mining to data centers to increase bitcoin holdings per share, responding to industry pressures created by the bitcoin halving and low mining revenue.

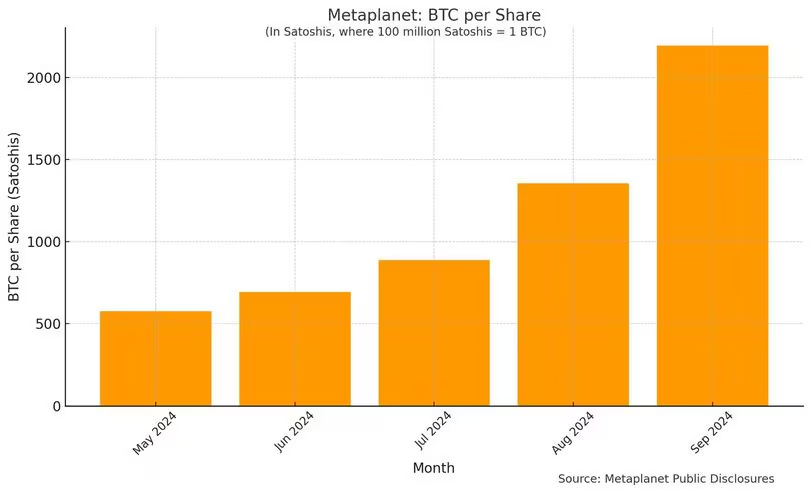

The goal of Metaplanet is to increase monthly bitcoin holdings per share, which has increased the stock value by 587% so far this year.

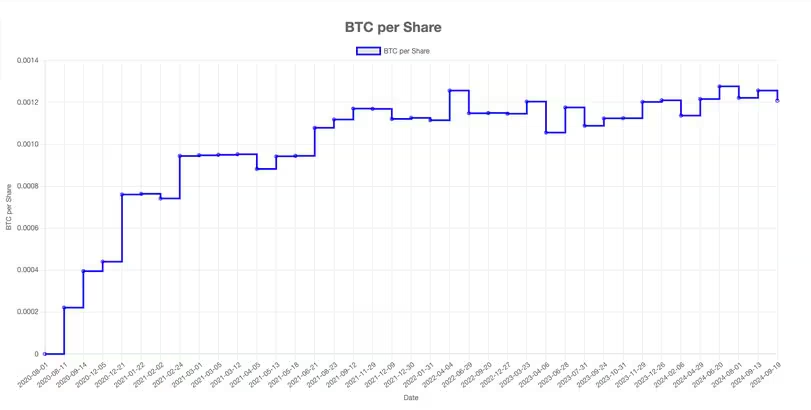

Bitcoin (BTC) has emerged as a significant treasury asset for public companies, a trend catalyzed by MicroStrategy’s (MSTR) decision to incorporate bitcoin into its corporate treasury in August 2020, resulting in an over 800% increase in its stock value. According to BitcoinTreasuries.net, public companies hold approximately 354,316 BTC, about 1.69% of the total bitcoin supply of 21 million.

As a result of this action, a number of other businesses have adopted bitcoin as a means of diversifying their revenue streams and fending off inflationary pressures. Among the most notable of these are Cathedra Bitcoin (CBIT), Metaplanet (3350), and Semler Scientific (SMLR).

Originally listed as a public company on the Canadian TSX Venture Exchange, Cathedra Bitcoin has shifted its focus from mining bitcoins exclusively to creating and managing data centers. The shift occurs as a result of the halving of bitcoin, which is posing growing difficulties for the mining sector. With an all-time low of 36 PH/s, the hashrate index, which measures the revenue from bitcoin mining, is currently at a comparatively low 43 (petahash/second) PH/s, which will make things difficult for many public miners in 2024.

Moving away from mining, Cathedra’s objective is now to maximize bitcoin holdings per share in order to produce a more stable cash flow. This change in direction enables the business to consistently add more bitcoin, putting more of an emphasis on long-term growth in bitcoin holdings than on expensive operating endeavors.

“Going forward, we will make all capital allocation decisions with the intention of maximizing our shareholders’ per-share bitcoin holdings,” the company said.

Simon Gerovich, the CEO of Metaplanet, is also involved in the bitcoin treasury space. Like Cathedra, Metaplanet is putting an emphasis on increasing the amount of bitcoin it owns. The company’s objective of increasing its holdings each month has been highlighted by Gerovich, and it has proven to be a successful strategy. The market’s favorable reaction to Metaplanet’s strategic approach is reflected in the company’s 587% rise in stock value thus far this year.

As the leading player in the bitcoin treasury market, MicroStrategy continues to be a trailblazer. The business is expanding the use of bitcoin and innovating under Michael Saylor’s direction. It revealed the pricing of a $875 million convertible senior notes offering on September 18, which was an increase from the original $700 million.

The notes mature in 2028 and have an interest rate of 0.625%. In order to lower the company’s interest payments, $500 million in high-interest 6.125% senior secured notes will be redeemed with the proceeds at a redemption price equal to 103.063% of the principal amount. More bitcoin will be purchased with the remaining funds. An additional $135 million in notes may be purchased by initial purchasers as part of the offering.

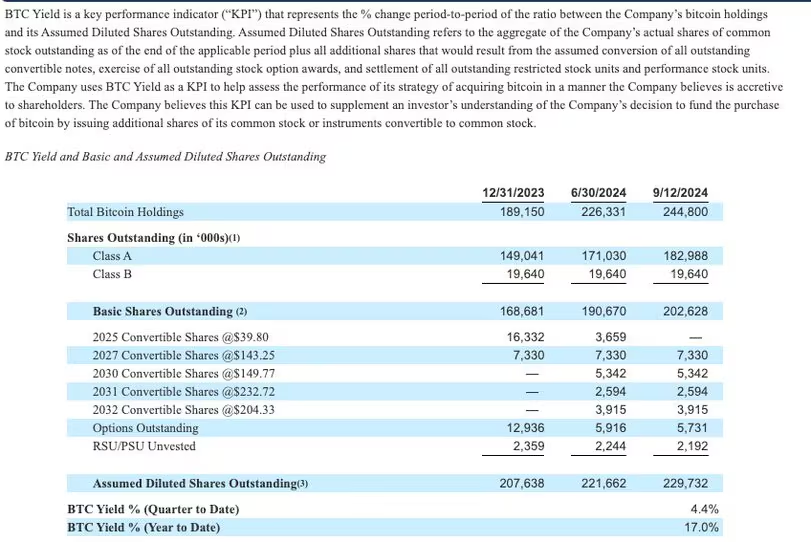

A novel idea known as “bitcoin yield” was unveiled by MicroStrategy in a recent 8-K filing. It quantifies the percentage change in the company’s bitcoin holdings in relation to its assumed diluted shares outstanding, which includes both Class A and Class B shares. The company’s bitcoin yield was 17% from January 1 to September 12, with a 4.4% yield thus far this quarter.

As per the MSTR-tracker, the ratio of bitcoin to shares is presently approximately 0.0012. According to this measure, long-term investors appear to be getting more value out of their bitcoin holdings.

Leave a Reply