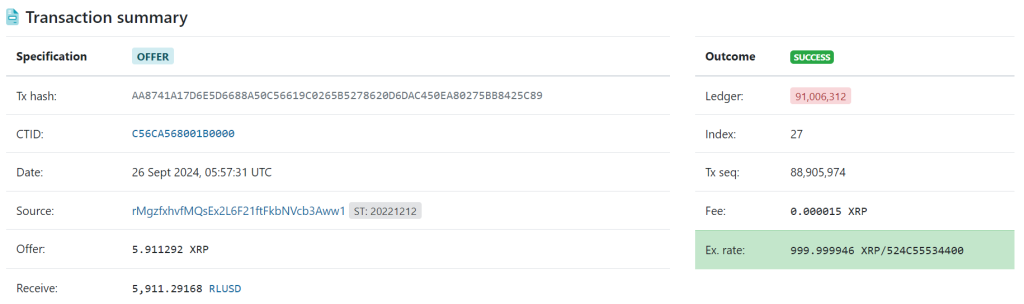

The transaction set an RLUSD rate that would place XRP at around $1,000 a piece, fuelling speculation.

With a few minor oscillations, the price of XRP has remained stable over the last day, rising by 0.08%.

Meanwhile, investors are perplexed by a transaction that values XRP at $1,000 per coin.

With XRP up just 0.25%, the dismal price action from last Friday continues.

Even though it has advanced somewhat, its performance has been noticeably worse than other prominent altcoins’ explosive growth during the same time frame.

Even with this very minor price movement, XRP is receiving more attention. Over the last 24 hours, the altcoin’s trading volume has increased by 19.03% to $1.236 billion.

Will the Transaction Push XRP to $1,000?

The September 26th transaction set an RLUSD rate that would place XRP at around $1,000 a piece, according to XRPscan.

Because of this highly sought-after valuation, traders went crazy, believing that XRP would reach $1,000 thanks to Ripple’s stablecoin.

This was soon shown to be untrue, though, as it turned out that the transaction was actually an offer for a decentralized exchange (DEX).

Pseudonymous XRP Validator Val provided commentary on X, clarifying that the transaction was “just a DEX offer. Anyone can offer those, and no one in their right mind would sell 6,000 RLUSD for 6 XRP.”

🚨RLUSD will not put #XRP at a $1000, folks.

— Vet 🏴☠️ (@Vet_X0) September 26, 2024

This is just a DEX Offer.

Anyone can offer those and no one in their right mind would sell 6k RLUSD for 6 XRP and even if it would be only for this one trade. #RLUSD is also not live. pic.twitter.com/IWXgz9MqHo

In a peer-to-peer transaction, users on DEXs can set a limit order that indicates the price at which they are willing to purchase or sell a specific cryptocurrency.

These transactions do not accurately represent the cryptocurrency’s worth. Val summarized, saying, “RLUSD will not put XRP at $1,000, folks.”

XRP Price is Not Going to $1,000, But How Far Can It Go?

Despite being disheartening, this does not negate the stablecoin’s ability to raise the price of XRP.

Although RLUSD will not directly increase XRP, it will assist in integrating users into the larger Ripple ecosystem, which may benefit the coin’s value in the long run.

A factor that supports an upward breakout from the 4-year symmetrical triangle pattern and adds to the increasingly bullish outlook for XRP.

Above all, it appears that XRP has taken solace in its new bullish lean, as its Relative Strength Index (RSI) holds steady above the neutral line at 55.

This is neutral, but it shows a significant bias in favor of buying pressure.

The Chaikin Money Flow (CMF), which is progressively exiting negative territory each week, reflects this sentiment as well. It is currently only half of what it was at the beginning of the month, at -0.057.

Bulls appear to be in control, supporting a near-term breakout, as the MACD line confirms a comfortable lead above the Signal line.

The price of XRP needs to break above the $0.60 mark and take back the 200 SMA as support in order to continue rising.

A clear break above these levels would suggest that the market is ready for a bigger rally and a change in attitude.

The magnitude of such a move might set off a 225% rally in the upcoming months, bringing the price back to its previous peak of $1.97.

However, with fundamental catalysts stacking up in favour of an altseason, the potential for even further growth is considerable.

Leave a Reply