Although altcoin season may not be here yet, analysts say one may be on the way soon.

An altcoin season is predicted as a result of the US Federal Reserve’s decision to reduce interest rates by 50 basis points, which has encouraged investors to invest in riskier assets.

The medium- to long-term outlook for cryptocurrencies is still positive, according to Mason Jappa, CEO and founder of the American Bitcoin miner Blockware, since riskier assets like Bitcoin are typically supported by lower interest rates.

He told us that “if Powell comes out with extremely dovish rhetoric, crypto will likely see a brief pump,” and that is exactly what happened—the market became extremely optimistic and the focus shifted to riskier assets.

Altcoins saw significant benefits from this, with significant inflows as new hands entered the market, pushing its market cap up $22 billion over the past 24 hours, according to Coingecko data.

This development confirms the remarks made by analyst Mustache, who goes by pseudonym, that traders are “not bullish enough” on altcoins. Mustache predicted that an altcoin season that will last until 2025 is based on past trends.

#Altcoins

— 𝕄𝕠𝕦𝕤𝕥𝕒𝕔ⓗ𝕖 🧲 (@el_crypto_prof) September 17, 2024

We're all not bullish enough.

Cycles repeat themselves.

2017-2021-2024/2025. pic.twitter.com/puQzHFYxrt

Has Altcoin Season Started?

On-chain metrics indicate that cryptocurrencies still have room to grow before a distinct altcoin season arrives, despite the recent upsurge in altcoin trading.

Data from Coincodex indicates that there has not been much of an impact on Bitcoin’s dominance. With the Fed’s rate decision, it has decreased by 0.6%. Even though this indicates a move in favor of altcoins, Bitcoin is still very much in use.

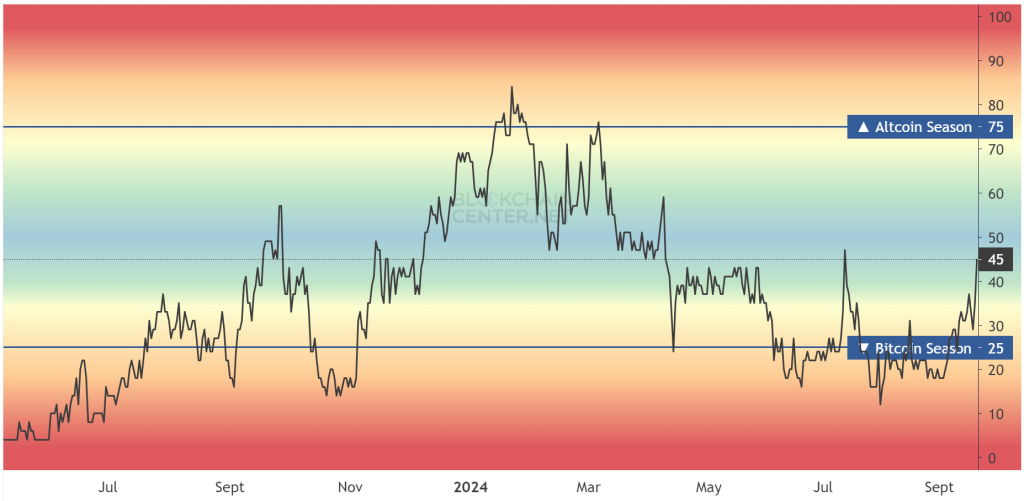

Blockchaincenter.net’s Altcoin Season index chart reinforces this, currently at 45, a neutral zone.

This is far below the benchmark of 75, which denotes the start of the altcoin season as money shifts from Bitcoin to other cryptocurrencies.

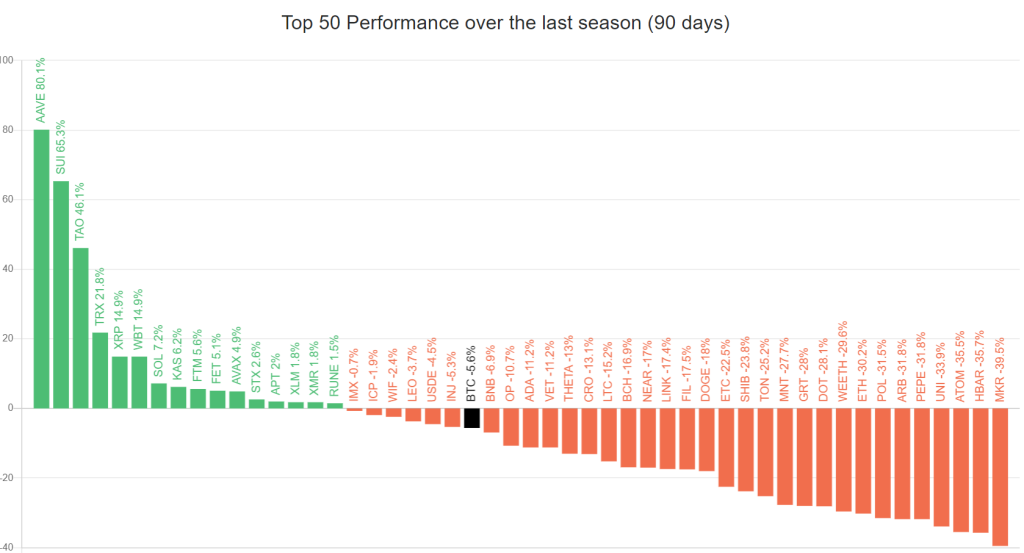

In contrast to Bitcoin, the top 50 altcoins by market capitalization exhibit noticeably poorer performance.

Only a small number of altcoins have been able to outperform the top cryptocurrency in the last ninety days, with the majority still being significantly negative. Although a 75% outperformance is thought to be the norm for an altcoin season, at the moment, barely 50% of altcoins surpass Bitcoin.

Analyst Point Next Two Quarters for Altseason Kick-Off

Although the altcoin season may not be in effect yet, in a September 20 X post, pseudonymous analyst Nilesh Rohilla noted a bullish breakout from the descending channel forming on the altcoin market cap chart.

Broadly speaking, the analyst pointed out that a breakout in Bitcoin would pave the way for a “parabolic” breakout in altcoins, presenting chances for large gains.

This sentiment was echoed by other analysts, who pointed to historical and technical patterns as grounds that the final quarter of this year could be a potential Bitcoin breakout point, with a six-figure Bitcoin “still in play” as we move toward 2025.

This forecast aligns with what is expected to be a monumental catalyst: the US presidential election, which will bring new all-time highs due to “positive drivers dominating regardless of the election outcome.

1 Comment