Analysts at CoinShares claim that rising mining difficulty and shifting hash prices have caused the average cost to produce one Bitcoin to soar to a new high of $49,500.

A number of issues are plaguing the Bitcoin mining sector, such as growing expenses, heightened competition, and challenging economic times.

A recent Q3 Mining Report published by CoinShares sheds light on the industry’s current state and future outlook.

Bitcoin Production Costs Hit New Highs

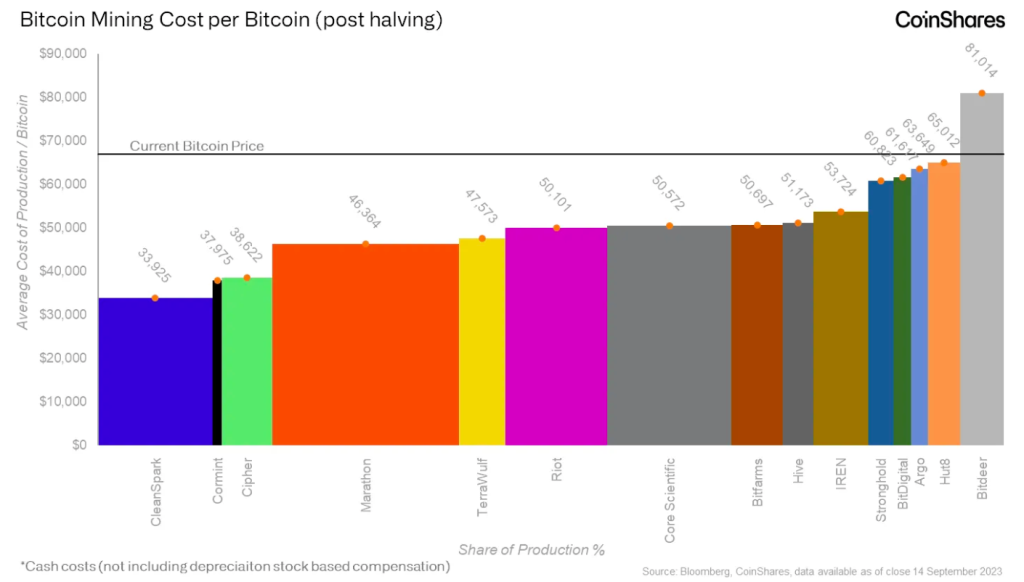

The rising cost of production is one of the main issues miners are dealing with. It now costs $49,500 on average to produce one Bitcoin (BTC), up from $47,200 in Q1 as mining difficulty increases and hash prices fall.

However, this only accounts for monetary expenses. The average cost price estimate would rise to $96,100 per Bitcoin due to depreciation and stock-based compensation.

According to the report, miners are using energy-efficient techniques like curtailment and alternative energy sources to reduce these expenses. Some miners, though, are finding it difficult to stay profitable in this setting.

The second issue is that miners are finding it more difficult to obtain funding as a result of the FTX collapse and growing interest rates. As a result, many are turning to “alternative funding sources, often through share issuance.”

This has a price, though, as it may reduce shareholder value. In the report, CoinShares analysts James Butterfill and Max Shannon observed, “While this serves as a useful funding option for miners, it has been frustrating for investors due to significant shareholder dilution.”

Bitcoin Miners Face Rising Costs and Stiff Competition

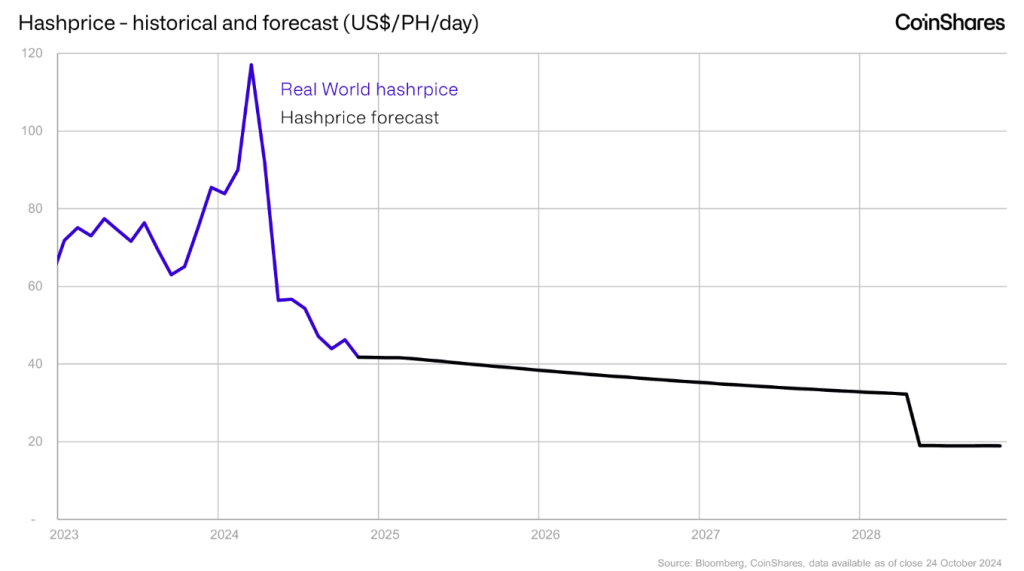

According to Butterfill and Shannon, Bitcoin’s hashrate is expected to increase from 684 EH/s to 765 EH/s by the end of 2024. It may even reach a theoretical upper limit by 2050, which would result in a 63% reduction in carbon emissions from flared gas. Nonetheless, until the subsequent halving event in 2028, hash prices are anticipated to decrease:

“Hash prices, a measure of potential miner profitability, have also achieved new lows this year, with our forecasting tool we expect them to continue to decline but remain range bound between $50–32/PH/day until the next halving event in 2028.”

Analysts also expect Bitcoin mining to become increasingly competitive, with miners with low costs and efficient operations having a significant advantage:

“Bitcoin mining’s long-term economics will likely face increasing pressure due to ongoing halvings and rising competition from self-miners, corporations, and even nation-states.”

At $16,700 per Bitcoin, private miner Cormint was the most affordable producer. TeraWulf, which benefited from fixed-rate power contracts and energy management techniques, came in second with a price of $18,700 per Bitcoin. According to the report, these businesses’ long-term success will depend heavily on their capacity to control expenses.

At $65,900 per Bitcoin, Riot, on the other hand, was the most expensive. But in Q2 2024, Riot received $13.9 million in power curtailment credits, which reduced its net power costs.

Can Bitcoin Mining Survive the Storm?

The CoinShares report also analyzes how miners are addressing current challenges.

Some Bitcoin miners, such as Riot, Cleanpark and Bitfarms, are taking a two-pronged approach – capital efficiency and diversification – by prioritizing efficient growth and focusing on acquiring pre-built assets rather than building new ones.

Other miners, such as Core Scientific, are venturing into artificial intelligence (AI) infrastructure to stabilize revenues and reduce dependence on the volatile price of Bitcoin.

The analysts concluded that the future of Bitcoin mining depends on effective cost management and capital allocation. Miners with robust strategies will be better positioned to navigate the increasing difficulty of mining and market volatility. The report reads:

Leave a Reply