Bitcoin and ether (ETH) saw daily gains of 2% to 3% on a positive day for cryptocurrencies.

Chartist Bob Loukas says that although BTC bottomed last week, it should rise further based on daily cycles theory.

Next week, the Federal Reserve is anticipated to reduce interest rates, though market players disagree on how much.

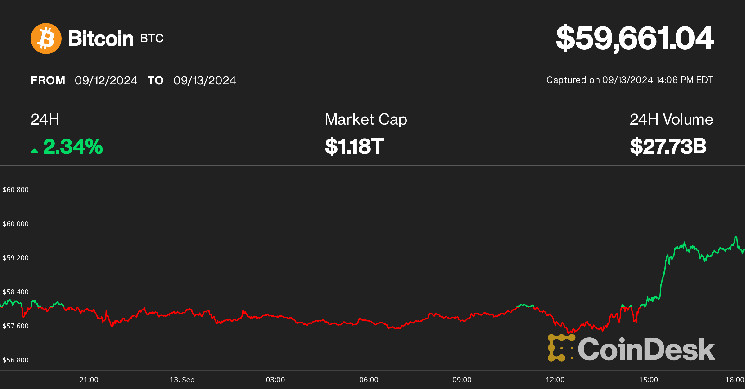

Bitcoin (BTC) increased in value on Friday, approaching the $60,000 mark, as a result of robust gains on traditional markets in general.

Following the announcement earlier in the day that software company MicroStrategy would be buying 18,300 BTC for $1.1 billion, the price of bitcoin fell by about 1% to $57,600. The biggest cryptocurrency soon made up for its losses and surged later in the day, rising 2.2% at $59,700 to end the day’s trading session.

In the same time frame, Ethereum’s ether (ETH), up 2.7%, regained the $2,400 mark. A cryptocurrency analytics company reported that as blockchain activity increased over the past week, Ethereum’s fee income increased by almost 60%.

The broad-market benchmark CoinDesk 20 Index advanced 2.5%, led by double-digit gains of Polygon’s native crypto (MATIC) as Binance added spot and perpetual trading of the recently upgraded POL token.

A few hours before the market closed, the S&P 500 was less than 1% from its record high set in July, and price action was taking place as U.S. stocks rose higher. Gold broke through previous records once again, reaching $2,600 an ounce for the first time ever. The rally in all asset classes was bolstered by a decrease in the value of the US dollar relative to major currencies.

More room to run

Based on the asset’s daily cycles analysis, well-followed trader and analyst Bob Loukas pointed out that there might be more fuel left in the tank for Bitcoin’s rally. Technical analysis’s cycle theory contends that prices fluctuate in waves and exhibit a specific periodicity between nearby peaks and troughs.

Based on a chart published on X, it appears that bitcoin probably reached a local low of less than $53,000 on September 6 and is currently in the seventh day of a new cycle. With the previous daily cycle lasting more than sixty days and peaking on the twenty-fourth day, Bitcoin had plenty of time to reach all-time highs before it ended.

“These cycles have time left should remain strong into FOMC,” Loukas said.

The Federal Open Market Committee (FOMC) meeting on Wednesday is the main event to watch this coming week. It is highly likely that this meeting will result in the Federal Reserve’s first interest rate reduction since 2020. According to CME FedWatch Tool, observers are still split on the cut’s size, with probabilities nearly evenly divided between a 25 basis point cut and a larger 50 bps cut.

Crypto investment firm Ryze Labs stated in a report on Friday that persistent worries about an impending recession weigh on the market, despite the possibility of looser monetary policy, which would in theory be advantageous to risk assets.

The report stated that “the state of the U.S. economy is the key variable here.” “If it remains resilient and avoids a recession, risk assets are likely to continue their upward trajectory. If not, then we’re in for a bumpy ride,” the report added.

Leave a Reply