More Bitcoin is anticipated to be purchased with the proceeds of this offering.

Bitcoin development company MicroStrategy announced its intention to offer $700 million aggregate principal amount of convertible senior notes due 2028.

The software firm said this private offering will be made available to qualified institutional buyers under Rule 144A of the Securities Act of 1933, as amended.

MicroStrategy announced that it is giving first buyers the opportunity to purchase an extra $105 million in notes in addition to the $700 million. This option may be exercised beginning on the date the notes are first issued and will last for 13 days.

There is some uncertainty surrounding the completion of this offering because the company made it clear that its success will depend on the state of the market.

Purpose and Use of Proceeds

It is anticipated that the net proceeds of this offering will be put toward purchasing more Bitcoin. MicroStrategy stated that it intends to redeem all of its $500 million Senior Secured Notes, which have an interest rate of 6.1% and are due in 2028.

The redemption of these notes is scheduled for September 26, subject to the sale and settlement of the new convertible notes. The redemption notice was sent out on September 16.

MicroStrategy Holds 244,800 BTC

The company disclosed during its earnings call that, as of July 31, it had increased its Bitcoin holdings to 226,500 bitcoins, at an average purchase price of $36,821 per bitcoin, for a total purchase price of about $8.3 billion.

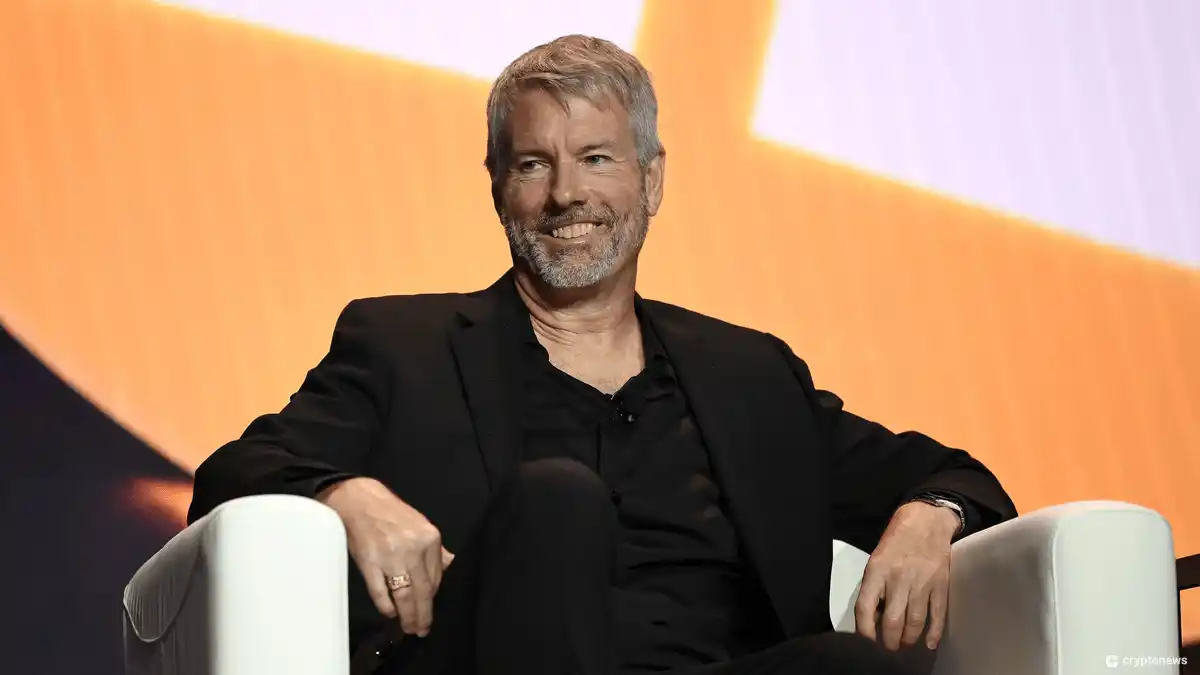

Market sentiment is still influenced by Michael Saylor’s enduring belief that Bitcoin is a superior store of value. He bought $1.1 billion worth of Bitcoin in September. Taking the total to 244,800 BTC. This indicates a robust institutional conviction regarding the cryptocurrency’s future prospects.

Saylor has continuously increased investor confidence in the asset, especially among institutional investors, with his aggressive accumulation.

Leave a Reply