Chair of the Federal Reserve Jerome Powell is sure to create a stir when he delivers the keynote address at the Jackson Hole Economic Symposium. Powell’s forthcoming speech may not be the first time central bankers have used this yearly event in Wyoming as a means of announcing changes in policy.

The markets are anticipating cues from the speech, which is set for this Friday, regarding possible interest rate reductions.

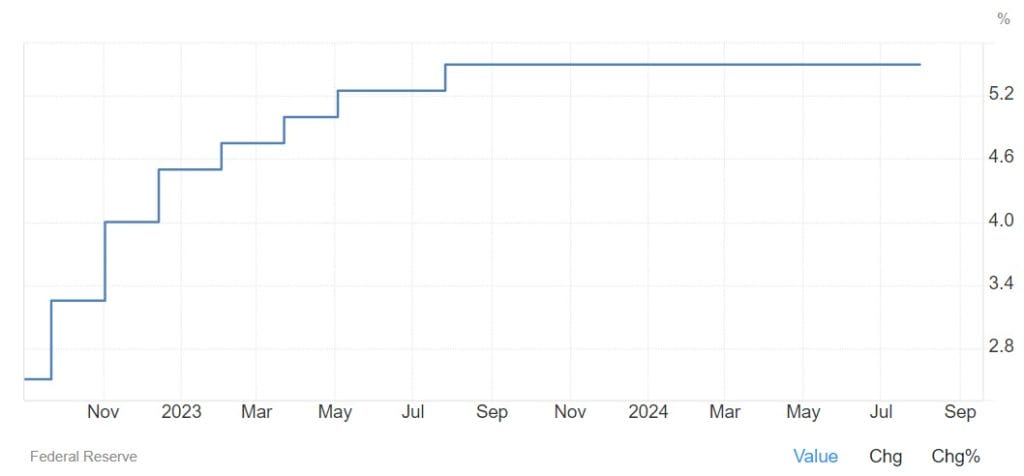

The Fed’s current benchmark rate is at a 23-year high, ranging between 5.25% and 5.50%. There is growing conjecture that the Fed could cut rates as early as September as inflation starts to slow and the labor market stabilizes.

Anticipating Market Shifts: Powell’s Upcoming Speech and Its Impact

The anticipation for Chair Jerome Powell’s impending speech grows as investors closely monitor the Federal Reserve’s next move.

The possibility of a rate cut is already being factored into the markets; according to data from CME Group, there is a 75% chance of a 25 basis point reduction in September and a 25% chance of a more significant 50 basis point reduction.

Powell is expected to indicate that a rate cut is imminent, but he might not be specific about how big of a cut it will be, according to Matthew Luzzetti, Chief U.S. Economist at Deutsche Bank.

If the upcoming jobs report is disappointing, the stakes could go higher and the likelihood of a bigger cut would increase. Powell’s speech is expected to be a critical one for investors, possibly determining how the markets will behave in the upcoming months.

Bitcoin Eyes Bullish Breakout: Key Levels to Watch Above $60,000

With an ascending triangle pattern providing support, the price of bitcoin (BTC/USD) is trading slightly above $60,000. This pattern usually indicates that the current trend will continue, implying that if BTC holds this support level, it may break higher.

The immediate resistance lies at $61,800, forming a triple-top pattern. Bitcoin prices may move towards higher resistance levels if they break above this resistance, which might indicate the start of a strong bullish trend.

The downside has $59,800 as immediate support and $57,883 and $56,151 as additional support. Bullish sentiment is maintained by additional support provided by the 50-day EMA at $59,811.

The RSI is at 54, indicating neutral momentum with room for further upside.

In conclusion, a bullish breakout above $61,800 should be watched for a possible continuation of the upward trend.

Leave a Reply