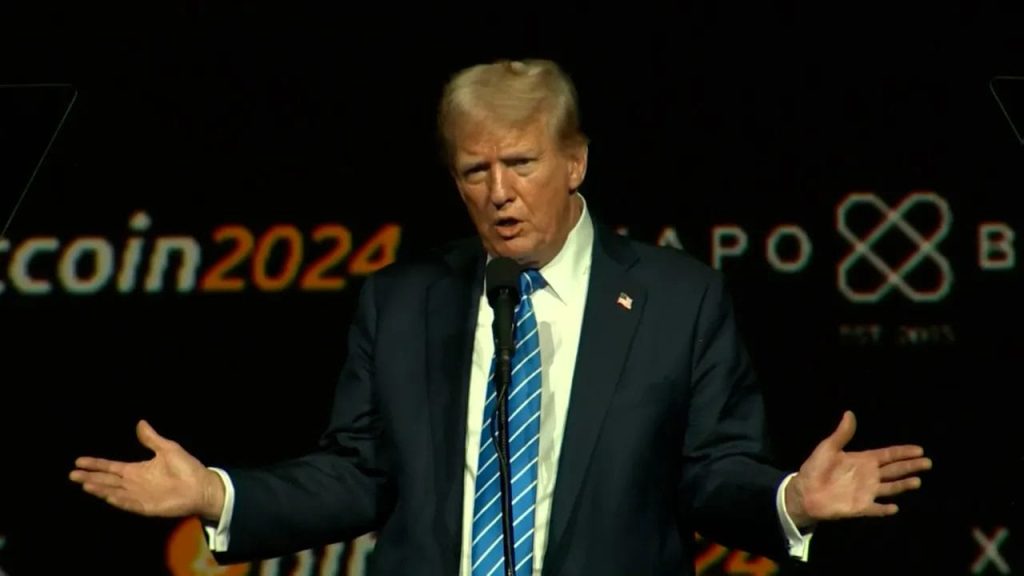

Former President Donald Trump burnished his credentials as Bitcoin’s best friend with a series of major announcements, including adding crypto to the government’s reserves, in a barnstorming speech to assembled crypto devotees at the Bitcoin 2024 Nashville conference.

“This afternoon, I’m laying out my plan to ensure that the United States will be the crypto capital of the planet and the Bitcoin superpower of the world and we’ll get it done,” said Donald Trump at the Bitcoin 2024 conference in Nashville, Tennesse on Saturday.

To roars of approval from the 5,000-strong audience, Trump promised, “On day one, I will fire Gary Gensler.” He continued: “I pledge to the Bitcoin community that the day I take the oath of office, Joe Biden and Kamala Harris’s anti-crypto crusade will be over.”

JUST IN: Crowd goes absolutely nuts after Donald Trump vows to fire SEC Chairman Gary Gensler during the Bitcoin Conference in Nashville, Tennessee.

— Collin Rugg (@CollinRugg) July 27, 2024

Trump was clearly taken aback at the crowd's reaction when he made the announcement.

"On day one, I will fire Gary Gensler and… pic.twitter.com/0CyOMaY6FY

Trump: crypto rules “will be written by people who love your industry”

“We will have regulations, but from now on, the rules will be written by people who love your industry, not hate your industry,” Trump proclaimed, in a statement that will send shivers down the spines of all US financial regulators and those elsewhere. He explicitly called for a reining in of enforcement activity by US financial regulators.

Likening the battles of the crypto industry with his own run-ins with the law, he stated that he would end “repression”. “They slander you as criminals but that happened to me, too, because I said the election was rigged,” said Trump.

In an extensive speech, he disclosed that his administration would establish a presidential advisory council for the cryptocurrency industry if elected.

Along with this, he stated that the Federal Reserve would not be allowed to create a central bank digital currency (CBDC). This is in line with Republican efforts at the state level to enact laws that prohibit the use of CBDCs for privacy-related reasons.

Stablecoin regulations would also be implemented under a Trump administration.

Insofar as it translates into policy, more astute and cunning Wall Street minds may recognize that regulation is a necessary precondition for cryptocurrency to gain widespread acceptance and thus work to moderate some of the ‘rip up all the rules’ Trumpian rhetoric.

Trump administration would create a strategic national bitcoin stockpile

In addition, the former president—who is campaigning for reelection in November—announced that he intended to establish a “strategic national bitcoin stockpile,” which would initially consist of the 210,000 BTC of bitcoin that the Department of Justice currently possesses.

He made no mention of whether or not the government ought to try to “seize and hold” cryptocurrency from criminals rather than adding to the pile by purchasing Bitcoin on the open market.

JUST IN – Trump, if President, pledges to form a Bitcoin Reserve, using 210,000 Bitcoin seized by the Department of Justice, as the core of a new “Strategic National Bitcoin Stockpile.” pic.twitter.com/ucvlyP3BDx

— Disclose.tv (@disclosetv) July 27, 2024

Never sell your bitcoin says Trumps, says it could surpass the market cap of gold

“Never sell your bitcoin,” declared Trump audaciously, adding that it is likely to surpass the market capitalization of gold in the future. The value proposition of Bitcoin has always been supported by the “digital gold” thesis.

Regardless of the outcome of the presidential election, Trump’s “Never sell” stance will probably help put a floor under the price of bitcoin, even if the market has not been able to reclaim the $70,000 mark since his remarks.

JUST IN: 🇺🇸 Donald Trump says #Bitcoin will one day probably surpass the market cap of Gold.pic.twitter.com/GTAjuIQDZ1

— wallstreetbets (@wallstreetbets) July 27, 2024

Wyoming Senator Cynthia Lummis was also present at the conference. The lawmaker disclosed that she is working on a bill that would direct the government to amass one million bitcoins over the course of five years. The bitcoin would need to be held by the government for at least 20 years. During that period, the only purpose of the bitcoin held was to reduce the US national debt.

Cantor Fitzgerald sets up $2 billion lending program to finance bitcoin

Meanwhile, financial services giant Cantor Fitzgerald’s CEO, Howard Lutnick, revealed plans for the firm to initiate a $2 billion lending program financing Bitcoin. Clients holding bitcoin will be able to access the leverage. According to a Bloomberg report, the firm will partner with select bitcoin custodians for its lending facility.

In another indication of the institutional shift away from the cryptocurrency asset class, Lutnick said in a colorful manner that the business possesses a “shedload of bitcoin.”

This election cycle, Cantor Fitzgerald has contributed $1.4 million to PACs that support Trump. In August, the CEO will throw a fundraiser for the president.

The renowned pro-crypto former National Security Agency contractor Edward Snowden, who fled to Russia after disclosing government surveillance data, was one of the conference’s other keynote speakers. It is possible that Snowden was not entirely in favor of the Trump cult: “Cast a vote, but do not join a cult.”

Harris is a know-show, but are Dems warming to crypto?

There were rumors earlier in the week that Kamala Harris, the presumed Democratic nominee for president, would give a speech at the Bitcoin 2024 conference, but this never materialized.

However, as Mark Cuban has revealed, the Democrats have reached out to him and others in the crypto world, seeking a possible reset of the party’s stance, which has been deemed hostile by many in the industry. As is to be expected for a Californian politician, Harris has strong links with Silicon Valley and is thought to favor a more ‘pro-innovation’ approach to crypto.

JUST IN: 🇺🇸 Kamala Harris’ staff have reached out to Mark Cuban with questions about ‘crypto’

— Radar🚨 (@RadarHits) July 23, 2024

“The feedback I’m getting… is that she will be far more open to business,” says Cuban pic.twitter.com/5hKBfon9MY

Wiley Nickel, a North Carolina Democratic lawmaker, attended the jamboree and publicly called for a crypto reset. Along with other Democrats, he has sent a letter to the Democratic National Committee urging a Harris administration to “select a pro-innovation SEC chair.”

Although Nickel received some courteous applause for his remarks, he was booed loudly when he brought up Trump’s anti-Bitcoin stance from his time as president, when he claimed that cryptocurrency was “a scam” and “based on thin air.”

Doubling down, he stated that Trump was “totally full of shit” on crypto.

“Historic moment” for crypto, Trump campaign backed by bitcoin miners

As of two days ago, Trump’s campaign had pulled in $4 million in crypto donations. That figure could be much more now.

Regarding Trump’s conversion to Damoclean, chief of staff for the conference Brandon Green stated: “Trump is a businessman and an entrepreneur, and he sees the opportunity that bitcoin affords the US and himself.”

More so than in the bitcoin mining industry, many in the crypto space are supporting the Trump campaign for apparent reasons.

Zachary Bradford, CEO of Cleanspark, called the Trump speech “a historic moment.” Trump has expressed his intention to limit bitcoin mining to the US and has hosted at least one gathering of mining executives at his home in Florida. “America will become the world’s undisputed Bitcoin mining powerhouse,” according to Bradford’s prediction.

Bitcoin price action still rangebound for now as Trump election campaign stalls

But the market’s reaction has not been as enthusiastic as some might have expected. After briefly rising above $69,000, the price of bitcoin has since dropped to 67,380.

The lackluster reaction can be attributed in part to the news having already been factored into the price, but more importantly, the “Trump trade” does not appear to be as safe a bet as it did under Joe Biden’s leadership as Trump’s opponent.

Harris is closing the gap on Trump and has passed him in some polls, although still within the margin of error.

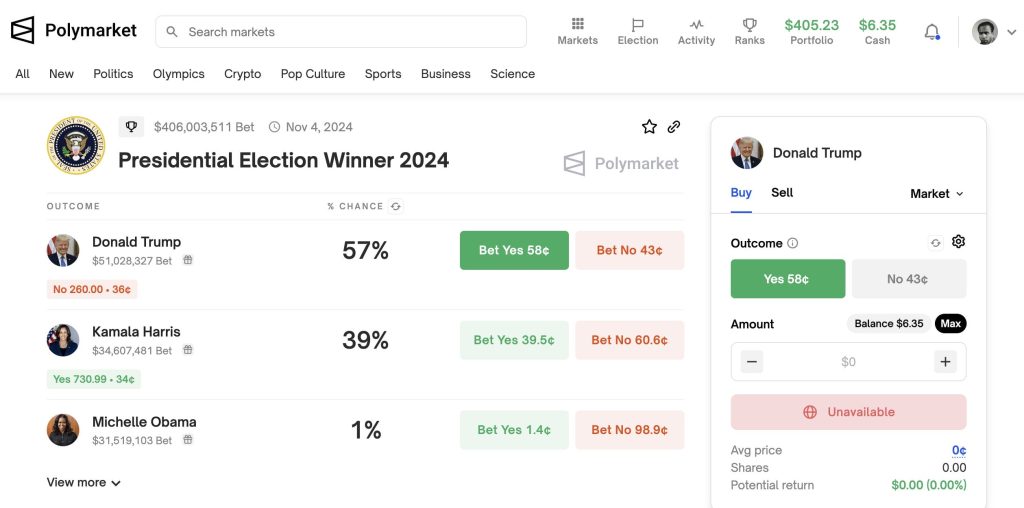

Betting on crypto-powered prediction market, Polymarket has Trump on 57 and Harris on 39, while PredictIt has the price at 54/49, respectively.

1 Comment