On July 1, the highly anticipated Markets in Crypto-Assets Regulation (MiCA) will finally come into force, bringing huge change to the landscape of stablecoins and other digital assets within the European Union (EU).

One of the most thorough regulatory frameworks for cryptoassets in the world, MiCA aims to safeguard investors, promote innovation in the quickly developing field of digital finance, and offer legal certainty.

Uphold and a few other exchanges have delisted DAI, FRAX, GUSD, USDP, TUSD, and USDT in an effort to comply with the regulations.

Jason Allegrante, chief legal and compliance officer at Fireblocks, stated that Europe is starting an experiment to bring digital assets and crypto market participants within the regulatory perimeter for the first time.

MiCA Caps Number of Transactions

Allegrante emphasizes, “One area that the regulations currently get wrong is stablecoins.” “Creating standards for issuers and reserves is a good idea, as is closing the market to those issuers or instruments that do not meet minimum standards,” adds Allegrante.

He clarifies that MiCA also imposes limits on the total amount of stablecoin transactions that can happen in a given amount of time.

“This will prove to be a major impediment to adoption and a disadvantage to EU-based stablecoins if left uncorrected in the next iteration of rules,” said Allegrante.

What You Need to Know About the New MiCA Stablecoin Rules

Stablecoins are defined by MiCA as electronic money tokens (e-money tokens) and asset-referenced tokens (ARTs). E-money tokens are tied to a single fiat currency, whereas assets-to-currency (ARTs) are linked to a basket of assets, including currencies and commodities.

To ensure that these tokens retain investor confidence and have a consistent value, the regulation establishes rules for their issuance, management, and oversight.

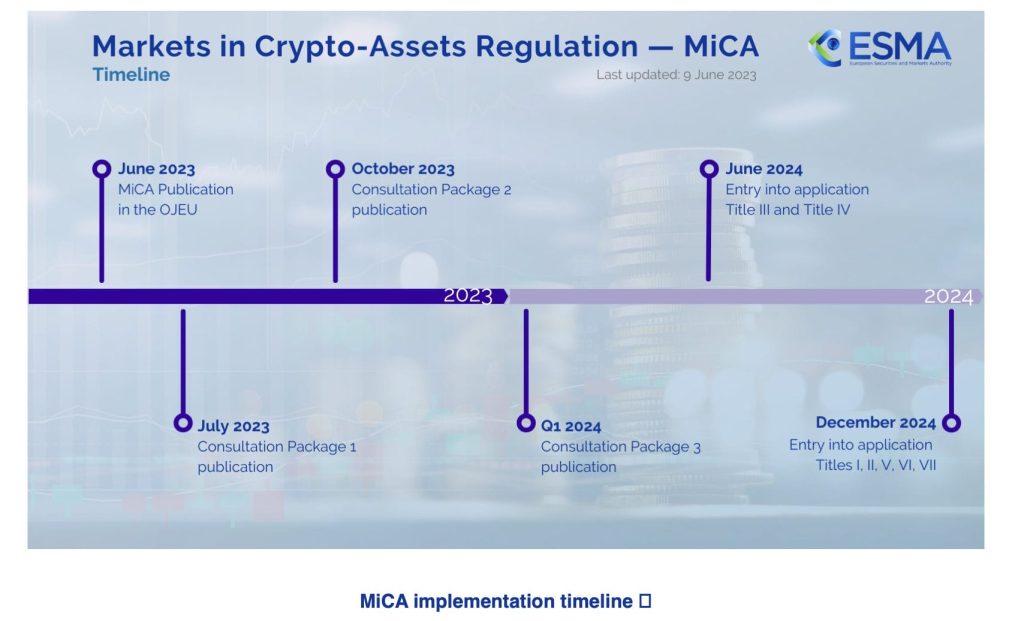

On July 1st, stablecoins, ARTs, and e-money tokens will be subject to the rules; on December 30th, other tokens and service providers will be subject to them.

Authorization and Supervision

Issuers of stablecoins are required by MiCA to obtain authorization from a national competent authority located within the European Union.

There are strict requirements for this authorization process. This entails showcasing adequate capital reserves, upholding open governance frameworks, and following sound risk management procedures.

In addition, issuers must release a comprehensive white paper detailing the features, entitlements, and value of the underlying asset of the token.

Operational Requirements

Issuers of stablecoins are also required to uphold a high standard of accountability and transparency. Regular audits and reporting on the reserve assets supporting the stablecoin are required by the MiCA.

It is necessary to retain these reserve assets in liquid, low-risk investments to guarantee the token’s stability and redeemability. In order to safeguard user funds and data, issuers must also put strong cybersecurity measures in place.

Consumer Protection

Of course, protecting consumers is one of MiCA’s main priorities. Strict disclosure requirements imposed by the regulation ensure that investors are fully aware of the characteristics of the stablecoin and the risks involved.

Issuers need to devise a mechanism for managing grievances and settling conflicts. The purpose of this framework is to increase investor confidence and create a safer atmosphere for transactions involving digital assets.

Market Integrity

MiCA contains guidelines to guarantee fair trading practices and stop market abuse. It encourages openness and integrity in the market by requiring stablecoin issuers to keep an eye on and report any suspicious activity.

By addressing concerns about insider trading and market manipulation, the regulation brings the cryptocurrency market more in line with established financial systems.

Impact on Innovation

In addition to imposing strict regulations, MiCA seeks to foster innovation in the EU’s digital finance sector. The regulation promotes responsible development and implementation of stablecoin technologies by offering a legal framework.

1 Comment