FTX Reorganization Moves Forward as US Bankruptcy Judge Grants Approval / Source: Cryptonews

FTX’s bankruptcy plan was recently approved by a US judge, paving the way for the company to repay creditors in excess of $16 billion. Some think this could be a major boon for the crypto market.

*JUDGE APPROVES FTX BANKRUPTCY PLAN, CLEARING PATH TO REPAYMENTS

— db (@tier10k) October 7, 2024

Source: DB

Judge John Dorsey of the US Bankruptcy Court for the District of Delaware approved the plan on Monday during a hearing.

According to that plan, 98% of FTX creditors will get at least 118% of their claim’s value in cash.

If FTX creditors decide to reinvest what they receive right away, some observers of the cryptocurrency market conjectured that this might lead to a rush of fresh capital entering the markets.

JUDGE APPROVES FTX BANKRUPTCY PLAN, CLEARING PATH TO REPAYMENTS

— Dominus Crypto (@Dominus_Crypto) October 7, 2024

MONEY WILL BE ENTERING THE MARKETS

BILLIONS DOLLARS STABLECOINS WILL BE DISTRIBUTED pic.twitter.com/T0Xqvl27m5

The distribution of FTX claims and the $18.3 billion in net inflows to Bitcoin ETFs since the beginning of 2024 were compared by cryptocurrency analyst Crypto Rover.

💥BREAKING: JUDGE APPROVES FTX BANKRUPTCY PLAN, CLEARING PATH TO $16 BILLION REPAYMENTS! pic.twitter.com/VS2bQpBruI

— Crypto Rover (@rovercrc) October 7, 2024

In a separate tweet, he argued that Bitcoin’s consolidation is over and that a new bull market will ensue.

The #Bitcoin consolidation phase is over.

— Crypto Rover (@rovercrc) October 7, 2024

Let the bull market begin. pic.twitter.com/tx6zJeEiZS

FTX Saga Finally Draws to a Close

The approval of FTX’s bankruptcy plan follows two fraught years of asset recovery and settlements following the exchange’s spectacular collapse in November 2022.

FTX’s disgraced former CEO Sam Bankman-Fried was sentenced to 25 years in prison last year over his involvement in the FTX fraud.

By combining funds with Bankman-Fried’s multibillion-dollar cryptocurrency hedge fund Alameda Research, FTX had deceived both its investors and customers.

Many FTX claimants will receive significantly less than the current value of their cryptocurrency, even though they will receive 118% of the claim’s value in cash.

Even though 94% of claimants supported the plan, some were not satisfied.

The plan was criticized by Sunil Kavuri, the representative of the largest group of creditors, who stated that claimants should receive payment in kind in cryptocurrency instead of cash, depending on the claim’s value at the time FTX filed for bankruptcy.

While this was going on, a claimant’s attorney stated that some clients would incur hefty tax bills if they were compensated in cash as opposed to cryptocurrency.

Will the FTT Token Make a Comeback?

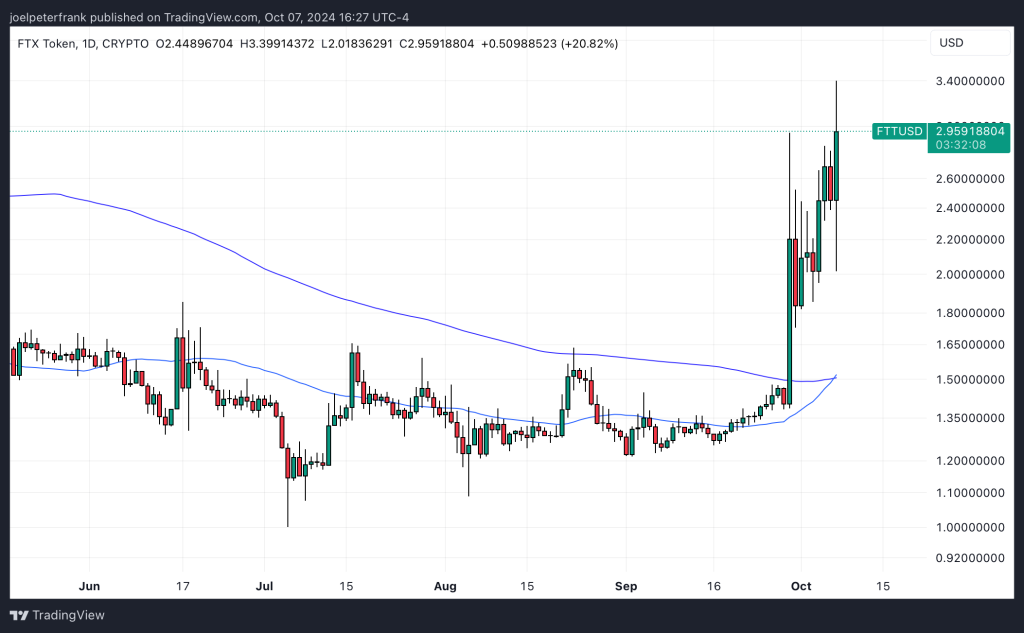

Judge Dorsey reiterated on Monday that the FTT token should have no value, but FTT has been increasing lately.

The utility token of the now-defunct FTX exchange was called FTT. TradingView reports that it last saw a 20% increase near $3.0, a two-fold increase over its price eight days prior.

If Dorsey is correct, though, this is not a wise investment.

“I have no evidence today that the value of FTT tokens would be anything other than zero,” he said.

With a market capitalization of about $1 billion, FTT has plenty of room to fall.

However, given its current status as a “meme coin,” it may be able to maintain its long-term value in a manner akin to that of the LUNC token on the defunct blockchain Terra, which has managed to maintain its speculative value.

Were FTX to have restarted its exchange, maybe FTT could have made a more robust recovery.

FTX CEO John J. Ray III told the WSJ in 2023 that the exchange had begun soliciting interested parties regarding a potential reboot.

That reboot would have included a substantial rebranding, but efforts were unsuccessful.

Leave a Reply