Stablecoins are becoming popular, which is noteworthy, but a recent analysis by blockchain analytics company Chainalysis discovered that stablecoins are often used for money laundering. Crypto-native money laundering happens when an on-chain wallet is connected to illicit activity, according to Kim Grauer, Director of Research at Chainalysis, who spoke with Cryptonews.com. “Exchange heists, crypto scams, and darknet market proceeds are on-chain money laundering examples, rather than off-chain activity like narcotics trafficking and fraud,” Grauer said.

“Because this flow of activity, from the placement stage to the conversion stage, occurs entirely on-chain, we refer to it as crypto-native money laundering.”

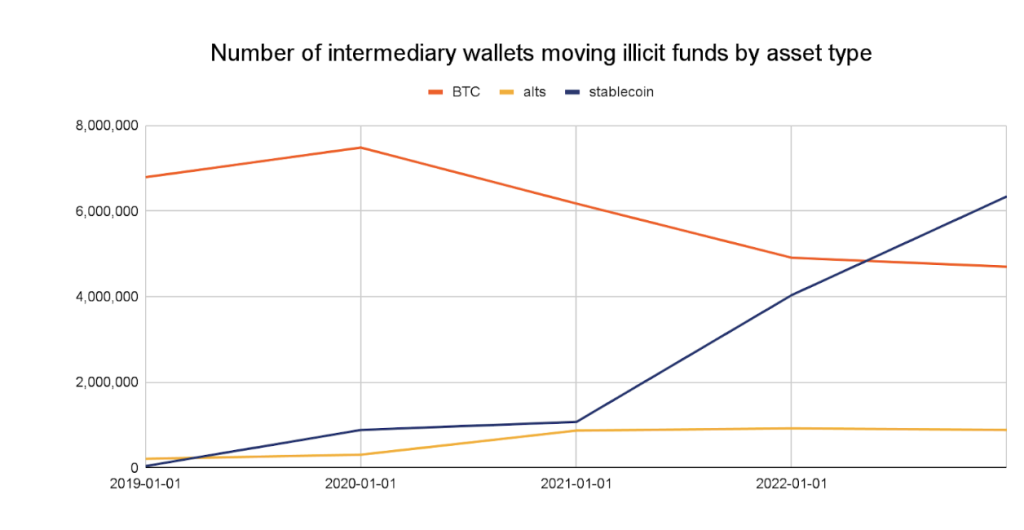

Chainalysis’ “Money Laundering and Cryptocurrency” report points out that an increasing portion of illicit funds passing through intermediary wallets are represented by stablecoins. This is consistent with Chainalysis’ previous findings that stablecoins now account for the majority of all illicit transaction volume.

Our Money Laundering report reveals how bad actors now use crypto to launder funds from off-chain crimes — not just crypto-native crimes like ransomware. We explore advanced tracing techniques and how blockchain data is leading the fight against fincrime.https://t.co/32ApuphHpU

— Chainalysis (@chainalysis) July 11, 2024

Why Stablecoins Are Used For Money Laundering

Grauer asserts that there is not a connection between illegal activity and stablecoins. Nonetheless, “both good and bad actors often prefer to hold funds in an asset with a value that will not change based on swings in the market,” according to the Chainalysis report.

The increased use of stablecoins by non-crypto native criminals for money laundering purposes could also be the cause of this trend. Grauer pointed out that in order to establish “large-scale money laundering infrastructure,” conventional money launderers are beginning to use crypto networks.

It seems that this is the case. According to Alan Orwick, co-founder of Layer-1 solution Quai Network, sanctioned entities are the main source of illicit transaction volume, according to a Chainalysis report obtained by Cryptonews.

“Specifically, $14.9 billion in volume from sanctioned entities accounts for 61.5% of all illicit transaction volume, surpassing other categories such as darknets, malware, and stolen funds,” Orwick said.

“Stablecoins offer a lucrative means of accessing the stability of the US dollar, even in the face of sanctions that are more easily enforceable on systems like SWIFT.”

Drawbacks of Using Stablecoins for Money Laundering

According to Grauer, despite the fact that stablecoins are being used for money laundering more frequently, there is not anything about their technical design that makes it better for illegal activity. Grauer actually brought up the fact that stablecoin holders have the ability to freeze illegal money if it looks suspicious. In line with this, stablecoin issuers have been addressing the problem of sanctioned entities by blocking or freezing those addresses, according to Jonathan Thomas, CEO and co-founder of Blueberry Protocol, who spoke with Cryptonews. For instance, in an attempt to stop money laundering, stablecoin issuer Tether (USDT) recently froze $5.2 million worth of USDT. The illicit funds were flagged by blockchain tracking platform MisTrack. The frozen USDT were distributed across 12 Ethereum (ETH) wallets, flagged as “USDT Banned Addresses.” The funds were suspected to have been laundered from numerous phishing schemes.Tether also froze addresses associated with sanctioned entities in April this year. This was in response to allegations that Venezuela’s state-run oil company, PDVSA, had been utilizing Tether to bypass sanctions imposed on its crude oil and fuel exports.“Blocking or freezing funds is accomplished by tracking certain patterns when it comes to how stablecoins are used,” Thomas explained.

“When an issuer sees a malicious pattern, that’s when they freeze transactions.”

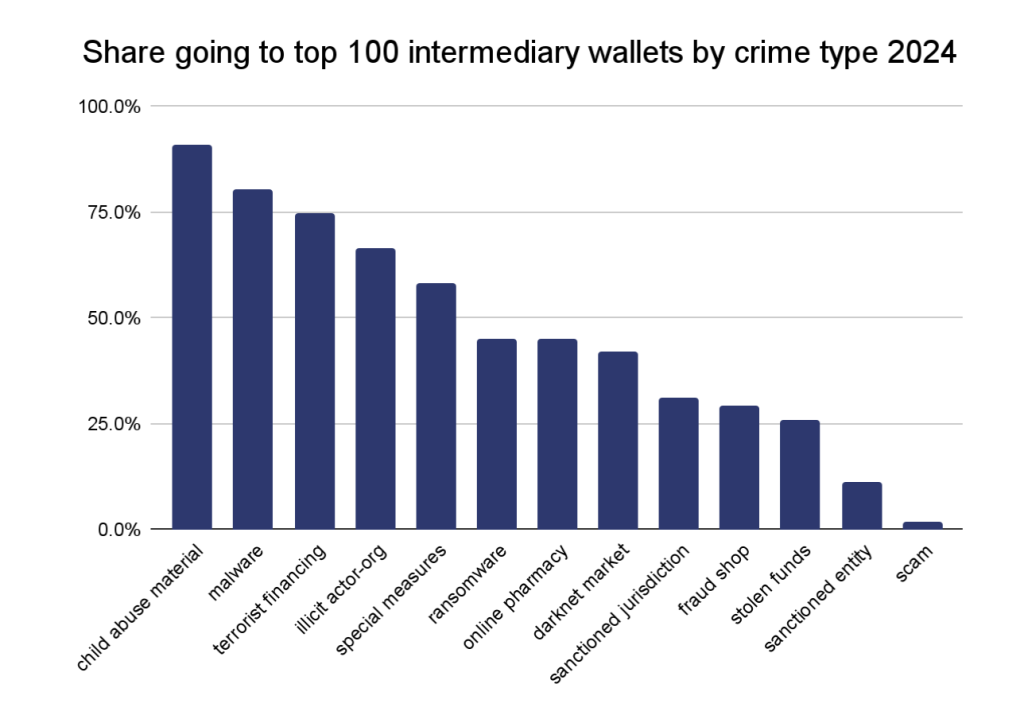

Grauer went on to say that intermediary wallets with a high concentration of money connected to criminal activity involving cryptocurrency can be found through data analysis from Chainalysis. These wallets, which receive cryptocurrency deposits from numerous other intermediary wallets, frequently serve as consolidation points.

“We define intermediaries as distinct unidentified wallets between two known endpoints,” Grauser said.

“In the case of money laundering, intermediaries are between an illicit wallet and a conversion service, and could involve a handoff (or multiple handoffs) from a cybercriminal to a professional money launderer, or it could be one individual sending crypto through many individual private wallets they control.”

Regulations Aim To Prevent Illicit Activity Using Cryptocurrency

Thomas went on to say that one way to stop illegal stablecoin transactions is to freeze or block money. However, he pointed out that laws aimed at dealing with dishonest people or approved organizations will aid in reducing this activity. Thankfully, Grauer mentioned that this is already happening. She said that anti-money laundering (AML) requirements, the Travel Rule, and the Fifth Anti-Money Laundering Directive of the European Union are all significant advances in the global enforcement of money laundering prevention. “Combined with enhanced Know Your Customer (KYC) and AML protocols on the part of crypto exchanges and traditional financial institutions, transaction monitoring systems and blockchain intelligence tools can enable a sustainable and secure framework that allows for innovation without illicit activity,” Grauer commented. In light of this, Grauer anticipates a decline in on-chain money laundering in the future. However, she pointed out that since many nations are still creating regulations, it is still challenging to forecast short-term trends.

1 Comment