The SEC’s heightened emphasis on enforcing regulatory compliance is demonstrated by the unprecedented $4.67 billion fine imposed against Terraform Labs.

In order to improve transparency and enforce regulatory compliance, the US Securities and Exchange Commission (SEC) has increased its oversight of the cryptocurrency sector in recent years.

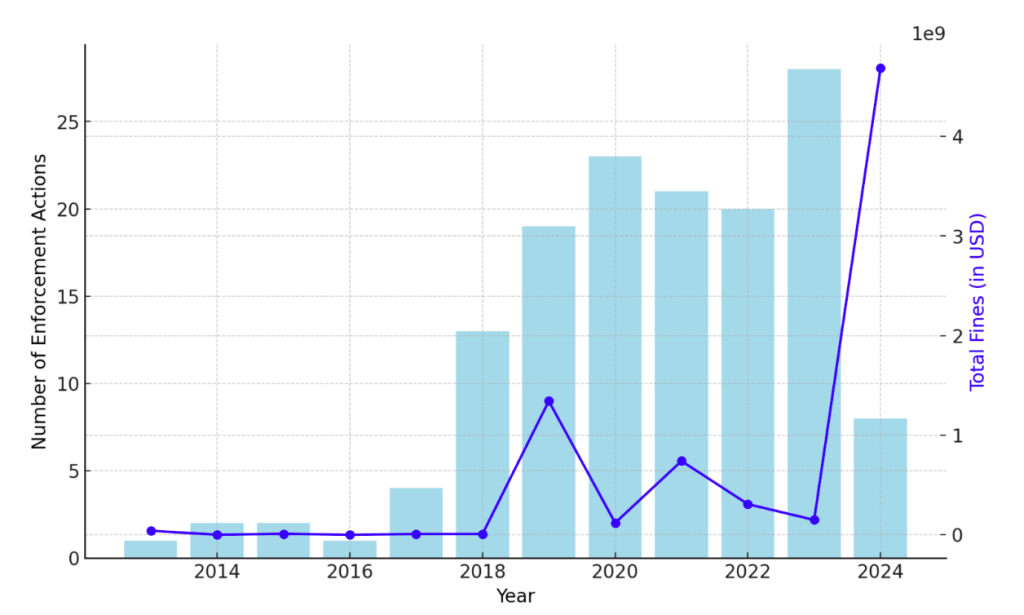

According to a Social Capital Markets report published on September 11, the SEC has fined cryptocurrency companies and individuals a total of $7.42 billion since 2013, with a whopping $4.68 billion assessed in 2024 alone.

A Rising Tide of Fines

The SEC greatly increased its enforcement efforts against executives and companies involved in cryptocurrencies in 2024.

$4.68 billion in fines were levied by the government agency, a sharp increase of 3,000% from 2023. The $4.67 billion fine imposed against Terraform Labs and its founder, Do Kwon, for breaking securities laws connected to the crash of the TerraUSD (UST) stablecoin, however, was the sole case that caused this spike.

The report states that even though the SEC only carried out 11 enforcement actions in 2024 (as opposed to 30 actions in 2023 and 21 actions in 2022), the average fine for the year hit a record high of $426 million. This rise is indicative of the SEC’s intention to pursue high-impact enforcement actions that establish industry-wide standards by imposing fewer but larger fines.

Billions in Fines for Crypto Industry Leaders

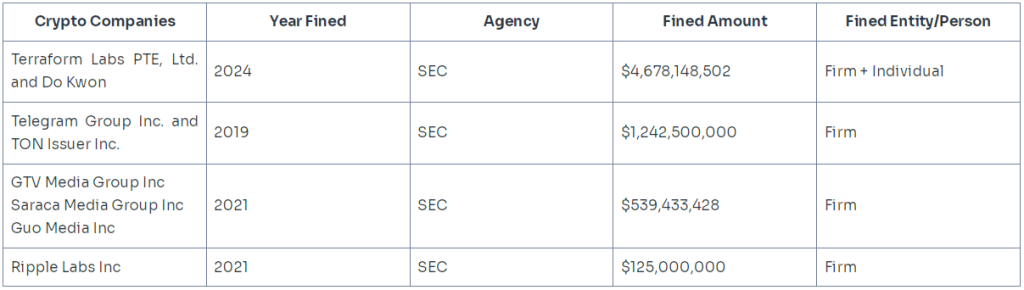

Apart from the historic litigation involving Terraform Labs and Do Kwon, the SEC has levied substantial penalties against several prominent cryptocurrency enterprises.

The SEC fined Ripple Labs $125 million in 2021 on the grounds that the business had sold XRP as an unregistered security. Within the cryptocurrency community, the case created a great deal of debate. Ripple maintained that XRP was a digital asset and not a security. The SEC’s action affected the digital asset market more broadly because numerous other cryptocurrencies were being investigated for possible violations of securities laws.

In 2019, the SEC fined Telegram Group Inc. $1.24 billion for conducting an unregistered offering of its Telegram Open Network (TON) token. Citing violations of securities laws, the SEC intervened to put an end to the project. This case emphasized the significance of adhering to regulatory requirements and served as a sobering warning to other cryptocurrency projects looking to raise capital through token sales.

SEC Targets Firms and Executives Alike

Executives at companies have also been the target of SEC enforcement actions.

The SEC has fined $5.08 billion since 2020 under the “Firm + Individual” category, demonstrating its emphasis on punishing both the corporate entities and the decision-makers responsible.

Leave a Reply