As of today, Bitcoin (BTC) is trading above $96,000 after dropping 5% over the previous week. Recent on-chain data indicates that market participants are becoming more bullish despite the price drop.

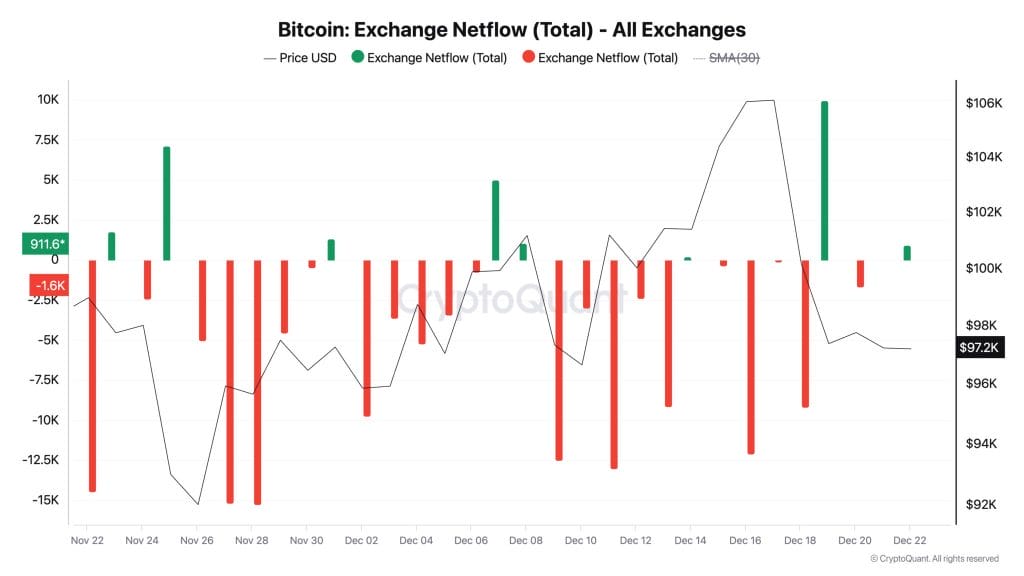

Over $2.5 billion worth of Bitcoin has been taken out of cryptocurrency exchanges over the last seven days, according to CryptoQuant, indicating a slowdown in selling pressure.

The quantity of Bitcoin transferred from exchange wallets to private holdings is known as exchange net outflows. Since investors usually move assets off exchanges when they intend to hold rather than trade or sell, large outflows are frequently interpreted as a bullish indicator.

Since there are fewer Bitcoins for sale, this trend is consistent with current market behavior and could accelerate price increases.

Bitcoin Technical Outlook: Resistance Levels in Focus

With stronger barriers at $99,500 and $102,650, Bitcoin is currently encountering immediate resistance at $97,250. A crucial support level on the downside is $94,300, with further zones at $92,140 and $90,345.

Mixed sentiment is highlighted by technical indicators. The RSI hovers near 46, leaning neutral but edging toward oversold conditions.

Dynamic resistance is provided by the 50-day EMA, which is situated at $96,385. The psychological $100,000 level might be reclaimed with a clear breakout above $97,250. Conversely, failure to clear resistance might trigger further declines to $92,000.

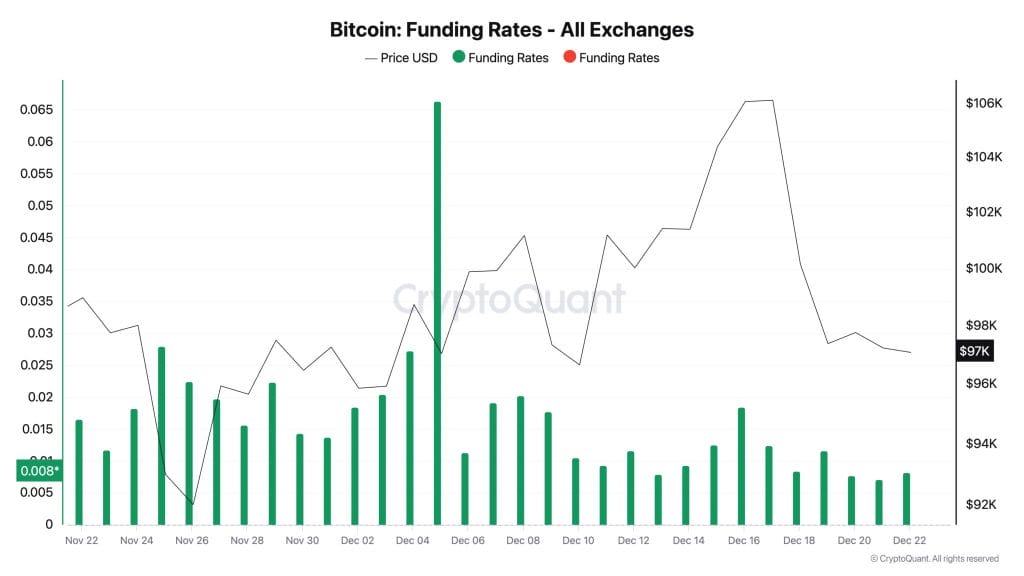

Funding Rates and Market Sentiment

At 0.0081, Bitcoin’s funding rate is currently positive in the perpetual futures market. A bullish outlook is reinforced by positive funding rates, which show that traders with long positions are paying those with short positions.

According to analysts, if funding rates and exchange outflows continue their upward trend, market volatility may be lessened and higher prices may be supported.

Key Takeaways

Funding Rates: A market that is inclined toward upward momentum is indicated by a positive funding rate of 0.0081.

Exchange Outflows: Over $2.5 billion in BTC has left exchanges, signaling reduced selling pressure and bullish sentiment.

Resistance Levels: Bitcoin must breach $97,250 to target $100,000; failure risks further declines toward $92,000.

Leave a Reply